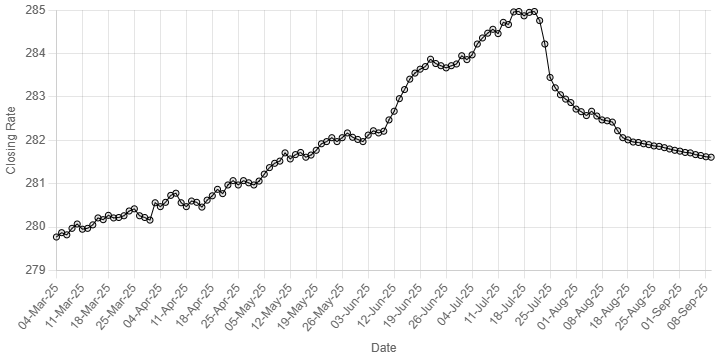

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee maintained its positive momentum against the US dollar, appreciating marginally in the inter-bank market on Tuesday.

At close, the rupee settled at 281.61, a gain of Re0.01 against the greenback. This was the rupee’s 23rd consecutive gain against the greenback.

On Monday, the local unit closed at 281.62.

Globally, the US dollar sank to an almost seven-week low on Tuesday as investors braced for US data revisions that could show the job markets in worse shape than initially thought, shoring up the case for even deeper Federal Reserve interest rate cuts.

The US dollar index fell to its lowest since July 24 in Asia trade to 97.344 ahead of the release of preliminary benchmark revisions for jobs data covering the period from April 2024 to March 2025.

Economists anticipate a downward revision of as many as 800,000 jobs, which could signal that the Federal Reserve is behind the curve in efforts to achieve maximum employment.

Advisors to the Trump administration are preparing a report laying out the alleged shortcomings of the Bureau of Labour Statistics, which they may publish in the coming weeks, The Wall Street Journal, opens new tab reported on Tuesday, citing unnamed sources.

Last month, US President Donald Trump fired BLS Commissioner Erika McEntarfer, accusing her, without evidence, of faking the employment data.

Oil prices, a key indicator of currency parity, rose more than 1% on Tuesday after the Israeli military said it carried out an attack on Hamas leadership in Qatari capital Doha, an expansion of its years-long military campaign across the Middle East.

Qatar, a major global energy exporter, condemned the attack as “cowardly” and called it a violation of international law.

Brent crude futures rose 74 cents, or 1.1%, to $66.76 a barrel by 11:39 a.m. ET, after hitting a session high of $67.38. US West Texas Intermediate crude futures also climbed 74 cents, or 1.2%, to $63 a barrel.

Inter-bank market rates for dollar on Tuesday

BID Rs 281.61

OFFER Rs 281.81

Open-market movement

In the open market, the PKR remained unchanged for buying and gained 10 paise for selling against USD, closing at 282.25 and 282.90, respectively.

Against Euro, the PKR lost 1.84 rupee for buying and 2.44 rupees for selling, closing at 332.44 and 335.59, respectively.

Against UAE Dirham, the PKR lost 19 paise for buying and 39 paise for selling, closing at 77.21 and 77.85, respectively.

Against Saudi Riyal, the PKR lost 14 paise for buying and 30 paise for selling, closing at 75.40 and 75.98, respectively.

Open-market rates for dollar on Tuesday

BID Rs 282.25

OFFER Rs 282.90

American Dollar Exchange Rate

American Dollar Exchange Rate