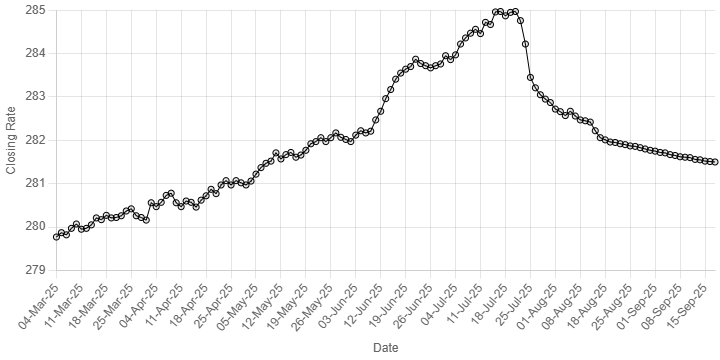

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”, “13-Jun-25”, “16-Jun-25”, “17-Jun-25”, “18-Jun-25”, “19-Jun-25”, “20-Jun-25”, “23-Jun-25”, “24-Jun-25”, “25-Jun-25”, “26-Jun-25”, “27-Jun-25”, “30-Jun-25”, “02-Jul-25”, “03-Jul-25”, “04-Jul-25”, “07-Jul-25”, “08-Jul-25”, “09-Jul-25”, “10-Jul-25”, “11-Jul-25”, “14-Jul-25”, “15-Jul-25”, “16-Jul-25”, “17-Jul-25”, “18-Jul-25”, “21-Jul-25”, “22-Jul-25”, “23-Jul-25”, “24-Jul-25”, “25-Jul-25”, “28-Jul-25”, “29-Jul-25”, “30-Jul-25”, “31-Jul-25”, “01-Aug-25”, “04-Aug-25”, “05-Aug-25”, “06-Aug-25”, “07-Aug-25”, “08-Aug-25”, “11-Aug-25”, “12-Aug-25”, “13-Aug-25”, “15-Aug-25”, “18-Aug-25”, “19-Aug-25”, “20-Aug-25”, “21-Aug-25”, “22-Aug-25”, “25-Aug-25”, “26-Aug-25”, “27-Aug-25”, “28-Aug-25”, “29-Aug-25”, “01-Sep-25”, “02-Sep-25”, “03-Sep-25”, “04-Sep-25”, “05-Sep-25”, “08-Sep-25”, “09-Sep-25”, “10-Sep-25”, “11-Sep-25”, “12-Sep-25”, “15-Sep-25”, “16-Sep-25”, “17-Sep-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67, 282.96, 283.17, 283.41, 283.55, 283.64, 283.70, 283.87, 283.77, 283.72, 283.67, 283.72, 283.76, 283.95, 283.86, 283.97, 284.22, 284.36, 284.47, 284.56, 284.46, 284.72, 284.67, 284.96, 284.97, 284.87, 284.95, 284.97, 284.76, 284.22, 283.45, 283.21, 283.05, 282.95, 282.87, 282.72, 282.66, 282.57, 282.67, 282.56, 282.47, 282.45, 282.42, 282.22, 282.06, 282.01, 281.96, 281.95, 281.92, 281.90, 281.87, 281.86, 281.83, 281.8, 281.77, 281.75, 281.72, 281.71, 281.67, 281.65, 281.62, 281.61, 281.60, 281.56, 281.55, 281.52, 281.51, 281.50

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee maintained its positive momentum against the US dollar, appreciating marginally in the inter-bank market on Wednesday.

At close, the rupee settled at 281.50, a gain of Re0.01 against the greenback. This was the rupee’s 29th consecutive gain against the greenback.

On Tuesday, the local unit closed at 281.51.

Internationally, the US dollar was on the defensive, shares edged lower, and gold scaled new heights on Wednesday as global markets counted down to an anticipated rate cut by the Federal Reserve later in the day and waited on signals around the extent of future easing.

The euro surged to a four-year high against the greenback in the prior session on the Fed easing bets, while oil remained firm following Ukrainian drone attacks on Russian refineries and ports.

The Fed was expected to cut its benchmark interest rate by a quarter of a percentage point to the 4.00%-4.25% range at the end of its monetary policy meeting later in the day. The main focus beyond the rate decision would be on Chair Jerome Powell’s comments on the outlook for US monetary policy.

The dollar index, which tracks the greenback against a basket of currencies of other major trading partners, edged up 0.1% to 96.689 after a 0.7% slide on Tuesday to the lowest since early July.

The European single currency was down 0.1% at $1.1857, after touching $1.1867 on Tuesday, its highest level since September 2021.

The US dollar was little changed at 146.52 yen following a 0.6% slide in the previous session.

Oil prices, a key indicator of currency parity, eased on Wednesday after data showed an increase in US diesel stockpiles, stoking worries about demand, as investors awaited the US Federal Reserve’s decision on interest rates.

Brent crude futures lost 44 cents, or 0.64%, to $68.03 a barrel by 11:29am EDT (1529 GMT) while US West Texas Intermediate crude futures were also down 44 cents, or 0.68%, at $64.08.

Inter-bank market rates for dollar on Wednesday

BID Rs 281.50

OFFER Rs 281.70

Open-market movement

In the open market, the PKR gained 2 paise for buying and remained unchanged for selling against USD, closing at 282.01 and 282.55, respectively.

Against Euro, the PKR lost 1.70 rupees for buying and 1.24 rupees for selling, closing at 334.05 and 337.01, respectively.

Against UAE Dirham, the PKR gained 4 paise for buying and 12 paise for selling, closing at 77.19 and 77.95, respectively.

Against Saudi Riyal, the PKR gained 6 paise for buying and 8 paise for selling, closing at 75.25 and 75.89, respectively.

Open-market rates for dollar on Wednesday

BID Rs 282.01

OFFER Rs 282.55

American Dollar Exchange Rate

American Dollar Exchange Rate