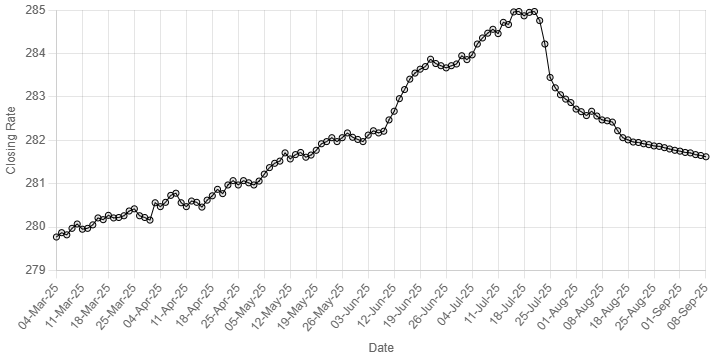

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee continued its winning run against the US dollar, appreciating 0.01% in the inter-bank market on Monday.

At close, the rupee settled at 281.62, a gain of Re0.03 against the greenback. This was the rupee’s 22nd successive gain against the greenback.

During the previous week, the Pakistani rupee settled on a positive note as it gained Re0.12 or 0.04% against the US dollar in the inter-bank market.

The local unit closed at 281.65, against 281.77 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the Japanese yen fell broadly on Monday following news that Japanese Prime Minister Shigeru Ishiba had resigned, while the US dollar was nursing losses after tumbling on a weak US jobs report that cemented expectations for a Federal Reserve rate cut this month.

Japan’s Ishiba on Sunday announced his resignation, ushering in a potentially lengthy period of policy uncertainty at a shaky moment for the world’s fourth-largest economy.

The yen slumped in response in Asia trade on Monday, falling 0.6% against the US dollar to 148.25.

The Japanese currency similarly slid to its lowest in more than a year against the euro and sterling at 173.91 and 200.33, respectively.

Meanwhile, the US dollar was recouping some of its heavy losses, helped in part by the yen’s weakness, after falling sharply on Friday on data that showed further cracks in the US labour market.

The nonfarm payrolls report showed US job growth weakened sharply in August, and the unemployment rate increased to nearly a four-year high of 4.3%.

Investors ramped up bets of an outsized 50-basis-point rate cut from the Fed later this month following the release and are now pricing in an 8% chance of such a move, as compared to none a week ago, according to the CME FedWatch tool.

Against the dollar, sterling fell 0.11% to $1.3492, having risen more than 0.5% on Friday. The euro was similarly down 0.11% at $1.1709, after hitting a more than one-month high on Friday.

The dollar index steadied at 97.87, after sliding more than 0.5% on Friday.

Oil prices, a key indicator of currency parity, climbed more than $1 on Monday, regaining some of last week’s losses, helped by the prospect of more sanctions on Russian crude after an overnight strike on Ukraine.

OPEC+ flagged plans to further increase production from October, but the amount was modest.

Brent crude climbed $1.24, or 1.9%, to $66.74 a barrel by 0640 GMT, while US West Texas Intermediate crude rose $1.17, or 1.9%, to $63.04 a barrel.

Both benchmarks fell more than 2% on Friday as a weak US jobs report dimmed the outlook for energy demand.

They lost more than 3% last week.

American Dollar Exchange Rate

American Dollar Exchange Rate