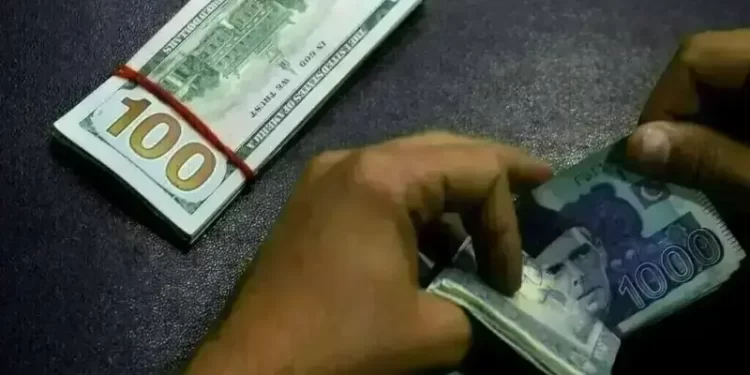

The foreign exchange reserves held by the State Bank of Pakistan (SBP) surged by $1.3 billion in a single week to reach a 3.9-year high, buoyed by the recent loan tranche disbursed by the International Monetary Fund (IMF), data from the central bank showed on Thursday.

The SBP reserves jumped to $15.89 billion as of December 12, 2025, after the central received $1.2 billion from the IMF under the Extended Fund Facility (EFF) and the Resilience and Sustainability Facility (RSF).

The central bank’s FX reserves stood above $15 billion last time during the week ended on March 11, 2022. During this time, the reserves fell to an alarming level of $2.9 billion in February 2023.

Meanwhile, the country’s total reserves stood at $21.09 during the week ended December 12, 2025. The reserves held by the commercial banks were recorded at $5.20 billion.

SBP-held foreign exchange reserves rise to $14.58bn

Last week, the IMF’s Executive Board approved the disbursement of $1.2 billion for Pakistan – $1 billion under the EFF and $200 million through the RSF.

“Pakistan’s policy efforts under the EFF have delivered significant progress in stabilising the economy and rebuilding confidence amid a challenging global environment and recent severe floods. Fiscal performance has been strong, with a primary surplus of 1.3% of GDP achieved in FY25, in line with targets.

“Inflation has increased, reflecting the impact of the floods on food prices, but this is expected to be temporary. Gross reserves stood at $14.5 billion at end-FY25, up from $9.4 billion a year earlier, and are projected to continue to be rebuilt in FY26 and over the medium term,” the IMF said in its statement.

The central bank surpassed its December 2025 target of $15.5 billion “despite sizable ongoing debt repayments”, the SBP said in its latest Monetary Policy Statement.

“Exports came under pressure, largely owing to a sharp decline in food exports, particularly rice. On the financing side, net inflows remained tepid. Despite this, SBP’s FX reserves have crossed the December 2025 target of $15.5 billion, led by continued FX purchases by the central bank.

“Going forward, global headwinds, especially from evolving trade dynamics, are likely to constrain exports, though lower global oil prices may contain import growth.

“On balance, the assessment for the current account is broadly unchanged, and the deficit is projected to remain within 0 to 1% of GDP in FY26. Moreover, with the realisation of planned official inflows, SBP’s FX reserves are projected to strengthen to $17.8 billion by June 2026,” the central bank said.

American Dollar Exchange Rate

American Dollar Exchange Rate