KUALA LUMPUR: Malaysian palm oil futures rose on Friday, buoyed by stronger rival Dalian and Chicago contracts and firmer crude oil prices, but chalked up a third consecutive weekly loss.

The benchmark palm oil contract for October delivery on the Bursa Malaysia Derivatives Exchange was up by 42 ringgit, or 1.13%, at 3,746 ringgit ($848.47) a metric ton by the close.

The contract lost 4.37% on the week after falling 1% over the previous two weeks.

Malaysian palm oil futures opened higher, lifted by a recovery in the soyoil, rapeseed oil and energy markets overnight, as well as a bullish recovery in Chinese vegetable oil futures in Asian hours, said Anilkumar Bagani, commodity research head at Mumbai-based Sunvin Group.

“The steady buying by India has further helped the palm oil cause.”

Dalian’s most active soyoil contract rose 0.32% while its palm oil contract advanced 1.44%. Soyoil prices on the Chicago Board of Trade were up 0.22%.

Palm oil tracks the prices of rival edible oils competing for a share of the global vegetable oils market.

Palm oil snaps 3-day losing streak to settle higher

Oil prices were steady on Friday and on course for a weekly gain of more than 3% as U.S. jobs data calmed demand concerns while fears of a widening Middle East conflict persisted.

Brent crude futures were up 0.03% at $79.19 a barrel by 0954 GMT. Stronger crude oil futures make palm a more attractive option for biodiesel feedstock.

The ringgit, palm’s currency of trade, strengthened by 1.23% against the dollar, making the commodity more expensive for buyers holding other currencies.

Palm oil inventories in Malaysia are expected to drop in July for the first time after rising for three consecutive months, a Reuters survey showed.

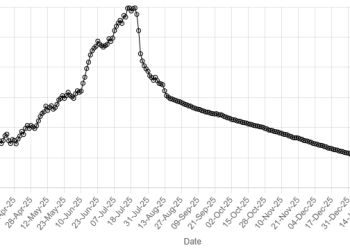

American Dollar Exchange Rate

American Dollar Exchange Rate