JAKARTA: Malaysian palm oil futures fell on Friday, pressured by a stronger ringgit and tracking weakness in rival Dalian edible oils, and booked their first weekly loss in three.

The benchmark palm oil contract for February delivery on the Bursa Malaysia Derivatives Exchange fell 45 ringgit, or 1.11%, to 4,018 ringgit ($981.68) a metric ton at the close, its lowest closing since November 25.

The contract declined 3.23% this week.

“Weakness of rival oils, coupled with a stronger ringgit, pressured palm prices today,” said a Kuala Lumpur-based trader.

The Dalian Commodity Exchange’s most-active soyoil contract dropped 0.5%, while its palm oil contract declined 1.27%. Soyoil prices on the Chicago Board of Trade slipped 0.35%.

Palm oil tracks price movements of rival edible oils as it competes for a share of the global vegetable oils market.

China’s state stockpiler Sinograin sold most of the soybeans it offered in an auction of state reserves, two traders said on Thursday, making room for an expected influx of U.S. cargoes amid abundant local supplies.

The ringgit, palm’s currency of trade, strengthened 0.37% against the U.S. dollar, making the commodity more expensive for foreign currency holders.

Oil prices rose on Friday, supported by concerns over Venezuelan supply disruptions, though they remained on track for a weekly decline as a supply glut and potential Russia-Ukraine peace deal remain in focus.

Stronger crude oil futures make palm a more attractive option for biodiesel feedstock.

Exports of Malaysian palm oil products for December 1-10 fell 10.3% from a month earlier, independent inspection company AmSpec Agri Malaysia said. According to Intertek Testing Services, exports fell 15% for the same period.

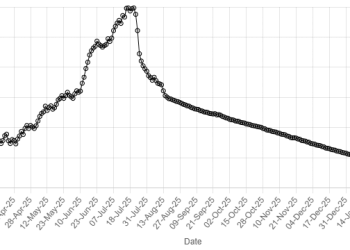

American Dollar Exchange Rate

American Dollar Exchange Rate