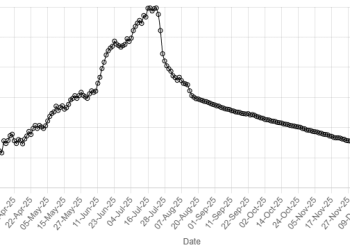

KUALA LUMPUR: Malaysian palm oil futures slipped on Friday, and the market is poised for a fifth weekly decline, as weak demand in November, a firmer ringgit and anticipated higher inventories are pressuring the market.

The benchmark palm oil contract for January delivery on the Bursa Malaysia Derivatives Exchange lost 22 ringgit, or 0.53%, to 4,103 ringgit ($971.35) a metric ton by the midday break.

The contract has shed 0.15% so far this week.

Lower November demand coupled with the strength in the ringgit is keeping the market under pressure, while elevated high-end stocks are also making it increasingly difficult to establish a bottom, said Paramalingam Supramaniam, director at Selangor-based brokerage Pelindung Bestari.

Malaysia’s production is expected to surpass 20 million tons for the first time in 2025, and the record output means it could likely end the year with higher-than-expected stocks.

Malaysia’s palm oil stocks had risen for an eighth consecutive month to a 6-1/2-year high by the end of October, as the biggest output in a decade outweighed a jump in exports, data from the industry regulator showed.

Cargo surveyors estimated that exports of Malaysian palm oil products for November 1-10 fell between 9.5% and 12.3%, compared to the same period a month earlier.

Dalian’s most-active soyoil contract remained unchanged, while its palm oil contract shed 0.8%.

Soyoil prices on the Chicago Board of Trade were up 0.44%. Palm oil tracks the price movements of rival edible oils, as it competes for a share of the global vegetable oils market.

India’s palm oil imports slid to their lowest level in five years during the 2024/25 marketing year, while purchases of soyoil soared to a record high as a widening price premium made palm oil less attractive to buyers, a leading industry body said.

Oil prices rose more than 2% after a Ukrainian drone attack damaged an oil depot in the Russian Black Sea port of Novorossiysk. Stronger crude oil futures make palm a more attractive option for biodiesel feedstock.

The ringgit, the palm’s currency of trade, weakened 0.1% against the dollar, making the commodity slightly cheaper for buyers holding foreign currencies.

Palm oil is biased to retest resistance at 4,145 ringgit per ton, a break above which could lead to a gain into the 4,171-4,213 ringgit range, Reuters technical analyst Wang Tao said.