KUALA LUMPUR: Malaysian palm oil futures ended more than 1% lower on Friday, snapping a three-week rally, as traders booked profits and concerns over rising output amid sluggish demand weighed on prices.

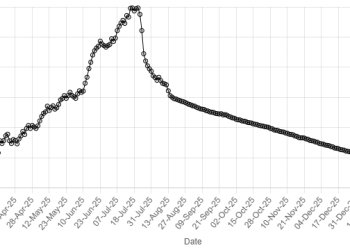

The benchmark palm oil contract for October delivery on the Bursa Malaysia Derivatives Exchange slid 54 ringgit, or 1.25%, to 4,276 ringgit ($1,013.75) a metric ton at the close. The contract fell 0.9% this week.

Crude palm oil prices have dipped after a recent rally due to profit-taking, said Paramalingam Supramaniam, director at brokerage Pelindung Bestari. Signs of a recovery in production amid tepid demand are also contributing to the decline, he added.

Malaysia’s crude palm oil production is likely to rise to 19.5 million metric tons in 2025 from 19.3 million tons a year earlier, the Malaysian Palm Oil Board said.

Cargo surveyors estimated that exports of Malaysian palm oil products for July 1-25 fell between 9.2% and 15.2% from a month earlier.

Malaysian palm oil climbs on short-covering

“The market is aware of potential output increases in the third quarter and current demand trends suggest that unless there is a pick up in demand, end stocks could rise above 2.1 million metric tons in July,” Paramalingam said.

Dalian’s most-active soyoil contract rose 0.39%, while its palm oil contract shed 0.95%. Soyoil prices on the Chicago Board of Trade were down 0.41%.

Palm oil tracks price movements of rival edible oils, as it competes for a share of the global vegetable oils market.

Oil prices were stable, as trade talk optimism supported the outlook for both the global economy and oil demand, balancing news of the potential for more oil supply from Venezuela.

Stronger crude oil futures make palm a more attractive option for biodiesel feedstock.

Meanwhile, the ringgit, palm’s currency of trade, weakened 0.12% against the dollar, making the commodity slightly cheaper for buyers holding foreign currencies.

American Dollar Exchange Rate

American Dollar Exchange Rate