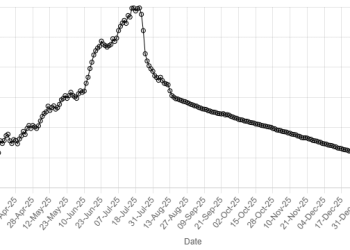

Trading kicked off at the Pakistan Stock Exchange (PSX) on a positive note amid days of selling pressure, with the benchmark KSE-100 Index gaining over 2,900 points during the opening hours of trading on Wednesday.

At 10:40am, the benchmark index was hovering at 176,084.86, following a gain of 2,934.45 points or 1.69%.

Buying momentum was observed in key sectors, including automobile assemblers, cement, commercial banks, oil and gas exploration companies, OMCs, power generation and refinery. Index-heavy stocks, including HBL, MCB, MEBL, MARI, OGDC, POL, PPL, HUBCO and PSO, traded in the green.

Pakistan’s current account returned to surplus in January 2026, supported by higher inflows of workers’ remittances.

According to the State Bank of Pakistan (SBP), the current account posted a surplus of $121 million in January 2026, compared with a deficit of $265 million in December 2025. On a year-on-year basis, the external balance also improved, as it also posted $393 million deficit in January 2025.

On Tuesday, PSX remained under pressure, extending its losing streak as sustained selling by foreign and local participants weighed heavily on equities amid broad-based weakness across the banking, energy, power, and telecom sectors. The benchmark KSE-100 Index declined by 1,303.52 points, or 0.75%, to close at 173,150.42 points.

Internationally, Asian stocks pushed higher on Wednesday despite the renewed artificial intelligence worries gripping international markets, while oil prices were under pressure after Iran touted progress in nuclear negotiations with the United States.

Japan’s benchmark Nikkei 225 index rose 0.93% to 57,090.14, poised to snap a three-day skid, while Australia’s S&P/ASX200 was up 0.5%.

Mainland China, Hong Kong, Singapore, Taiwan and South Korea were among the markets closed for Lunar New Year holidays.

The positive start in Asia followed a lacklustre session on Tuesday on Wall Street as investors grappled with the outlook for the AI boom.

Concerns that companies are over-investing, along with angst about the extent to which the nascent technology could disrupt labour markets, have fuelled investor jitters in recent weeks.

In the US overnight, the Dow Jones Industrial Average rose 0.07% to 49,533.19, the S&P 500 was up 0.10% at 6,843.2,2 and the Nasdaq Composite gained 0.14% to 22,578.38. The S&P 500 fell 0.88% initially before making up ground to close in positive territory.

This is an intra-day update

Trading kicked off at the Pakistan Stock Exchange (PSX) on a positive note amid days of selling pressure, with the benchmark KSE-100 Index gaining over 2,900 points during the opening hours of trading on Wednesday.

At 10:40am, the benchmark index was hovering at 176,084.86, following a gain of 2,934.45 points or 1.69%.

Buying momentum was observed in key sectors, including automobile assemblers, cement, commercial banks, oil and gas exploration companies, OMCs, power generation and refinery. Index-heavy stocks, including HBL, MCB, MEBL, MARI, OGDC, POL, PPL, HUBCO and PSO, traded in the green.

Pakistan’s current account returned to surplus in January 2026, supported by higher inflows of workers’ remittances.

According to the State Bank of Pakistan (SBP), the current account posted a surplus of $121 million in January 2026, compared with a deficit of $265 million in December 2025. On a year-on-year basis, the external balance also improved, as it also posted $393 million deficit in January 2025.

On Tuesday, PSX remained under pressure, extending its losing streak as sustained selling by foreign and local participants weighed heavily on equities amid broad-based weakness across the banking, energy, power, and telecom sectors. The benchmark KSE-100 Index declined by 1,303.52 points, or 0.75%, to close at 173,150.42 points.

Internationally, Asian stocks pushed higher on Wednesday despite the renewed artificial intelligence worries gripping international markets, while oil prices were under pressure after Iran touted progress in nuclear negotiations with the United States.

Japan’s benchmark Nikkei 225 index rose 0.93% to 57,090.14, poised to snap a three-day skid, while Australia’s S&P/ASX200 was up 0.5%.

Mainland China, Hong Kong, Singapore, Taiwan and South Korea were among the markets closed for Lunar New Year holidays.

The positive start in Asia followed a lacklustre session on Tuesday on Wall Street as investors grappled with the outlook for the AI boom.

Concerns that companies are over-investing, along with angst about the extent to which the nascent technology could disrupt labour markets, have fuelled investor jitters in recent weeks.

In the US overnight, the Dow Jones Industrial Average rose 0.07% to 49,533.19, the S&P 500 was up 0.10% at 6,843.2,2 and the Nasdaq Composite gained 0.14% to 22,578.38. The S&P 500 fell 0.88% initially before making up ground to close in positive territory.

This is an intra-day update