After a brief positive start, profit-taking returned to the Pakistan Stock Exchange (PSX) with the benchmark KSE-100 Index shedding nearly 1,600 points on Tuesday.

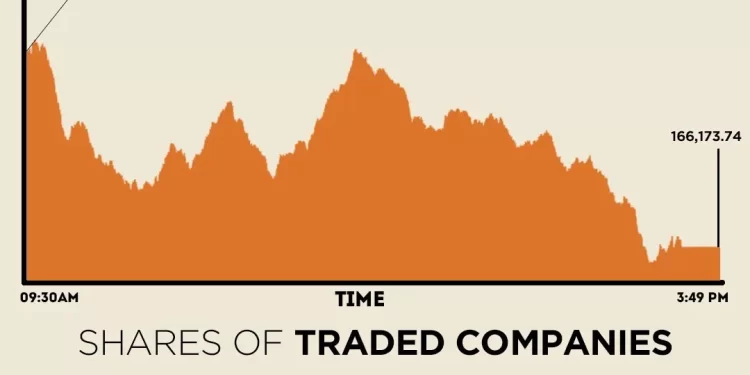

A volatile session was observed at the bourse, with the benchmark swinging both ways. In the opening minutes, the KSE-100 Index hit an intra-day high of 168,518.97.

However, investors soon resorted to profit-taking, dragging the index to an intra-day low of 165,997.21.

At close, the benchmark index settled at 166,173.74, a decrease of 1,578.66 points or 0.94%.

“The negative close was largely attributed to heavy profit-taking by local institutions, which overshadowed early gains and dragged the market into the red zone,” brokerage house Topline Securities said in its post-market report.

The decline was largely driven by losses in stocks such as HUBC, ENGROH, LUCK, MARI, and UBL, which collectively dragged the index down by 986 points. However, partial support came from HBL, EFERT, AKBL and ABL, contributing a combined 380 points, it added.

In a key development, the International Monetary Fund (IMF) and Pakistani authorities on Monday deliberated on revising downward the GDP projection to 3.5% for the current fiscal year against the government target of 4.2%, as recent floods caused damage to infrastructure, agriculture, and livestock.

Sources told media that in view of the damages caused by recent floods and external factors, an increase in inflation is anticipated.

On Monday, the PSX closed on a broadly negative note as investor sentiment was pressured by escalating geopolitical tensions with India and heightened profit-taking. The benchmark KSE-100 Index ended at 167,752.41 points, losing 1,237.66 points, or 0.73%.

Internationally, political upheaval in Japan and France gripped currency and bond markets for a second day running on Tuesday, while global shares stuttered despite a multi-billion dollar chip-supply deal between AMD and OpenAI.

The weekend election of fiscal and monetary dove Sanae Takaichi as leader of the ruling party in Japan propelled the Nikkei to yet another record high early in the session, as her likely appointment as the country’s next premier stoked bets on a revival in big spending and loose monetary policy.

In France, the shock resignation of Sebastien Lecornu as prime minister threw the nation deeper into political crisis and unnerved markets.

French OAT futures fell slightly in the early Asian session after bonds tumbled on Monday, while the euro came under pressure and dipped 0.06% to $1.1706.

The political jolts across major economies, made no better by a U.S. government shutdown, gave investors little to cheer about, with the overall mood sombre, overshadowing enthusiasm about artificial intelligence.

Markets in Hong Kong and China were closed for a holiday. The MSCI’s broadest index of Asia-Pacific shares outside Japan swung between gains and losses to last trade flat.

Meanwhile, the Pakistani rupee registered an improvement against the US dollar, appreciating 0.01% in the inter-bank market on Tuesday. At close, the currency settled at 281.22, a gain of Re0.03 against the greenback.

Volume on the all-share index decreased to 1,266 million from 1,274 million recorded in the previous close. The value of shares declined to Rs54.22 billion from Rs60.54 billion in the previous session.

P.T.C.L. was the volume leader with 180.61 million shares, followed by B.O.Punjab with 134.74 million shares, and Cnergyico PK with 90.72 million shares.

Shares of 487 companies were traded on Tuesday, of which 183 registered an increase, 267 recorded a fall, while 37 remained unchanged.