After hitting a record high in the previous session, the Pakistan Stock Exchange (PSX) ended trading on a stable note, with the KSE-100 Index closing relatively unchanged on Wednesday.

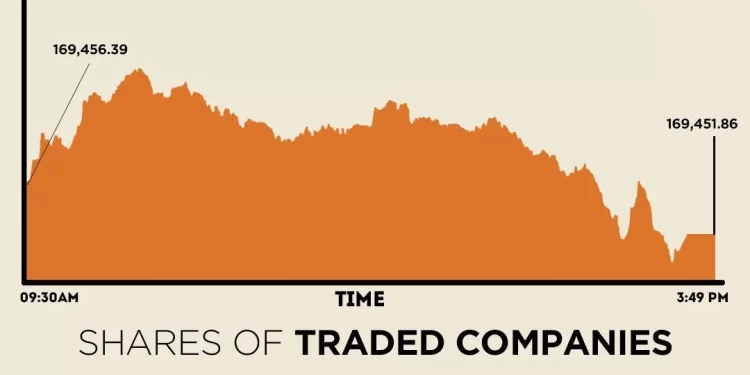

The benchmark index opened around the 169,000 level and quickly moved upward, gaining momentum in the early hours, hitting an intra-day high of 170,697.74.

However, the index drifted slightly lower, losing some earlier gains in the latter part of the session amid mild profit-taking.

At close, the KSE-100 settled at 169,451.86, a marginal decrease of 4.52 points.

Positive momentum came from MLCF, LUCK, ISL, FCCL, and PIOC, which together contributed 498 points to the index. However, this strength was partly tempered by declines in FFC, SRVI, and PPL, which collectively shaved off 380 points, brokerage house Topline Securities said in its post-market report.

On Tuesday, PSX extended its bullish momentum, with the index rallying strongly as investors built fresh positions across major sectors and overall market activity rose sharply. The KSE-100 advanced 1,153.14 points, an increase of 0.69%, to close at 169,456.39.

In a significant economic development, the US Export-Import Bank approved $1.25 billion in financing to support the mining of critical minerals at Reko Diq in Pakistan.

Internationally, Asian shares and Wall Street futures gave ground on Wednesday as crunch time neared for a divided Federal Reserve policy board, and earnings results threatened to test sky-high valuations in the AI space.

With most assets frozen in the Fed headlights, attention was grabbed by a sudden slide in the Japanese yen and the continued dizzy ascent of silver prices, which both hit record peaks.

The futures market, at least, is confident the Fed will cut rates by a quarter point to 3.50-3.75% later in the day, pricing it at a 89% probability. Yet it also assumes the guidance will be hawkish, implying just a 21% chance of a January move.

Much will depend on how many “dot plot” forecasts from Fed members see one, two or no more cuts next year. Analysts also suspect that at least two of the 12 voters could dissent against an easing, putting Chair Jerome Powell in a difficult position.

MSCI’s broadest index of Asia-Pacific shares outside Japan eased 0.1%, as Chinese blue chips fell 0.8% in the wake of mixed inflation data.

Meanwhile, the Pakistani rupee saw marginal improvement against the US dollar, appreciating 0.01% in the inter-bank market on Wednesday. At close, the local currency settled at 280.37, a gain of Re0.03 against the greenback.

Volume on the all-share index increased to 1,190 million from 1,031 million recorded in the previous close. The value of shares declined to Rs50.49 billion from Rs51.32 billion in the previous session.

Hum Network was the volume leader with 132.04 million shares, followed by Bank Makramah with 103.48 million shares, and TPL Properties with 52.37 million shares.

Shares of 478 companies were traded on Wednesday, of which 251 registered an increase, 188 recorded a fall, and 39 remained unchanged.