The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 Index ended 3-session buying rally as the Friday’s session succumbed to profit-taking, ending the day lower by 938 points.

The KSE-100 started the session positive, hitting an intra-day high of 114,444.01.

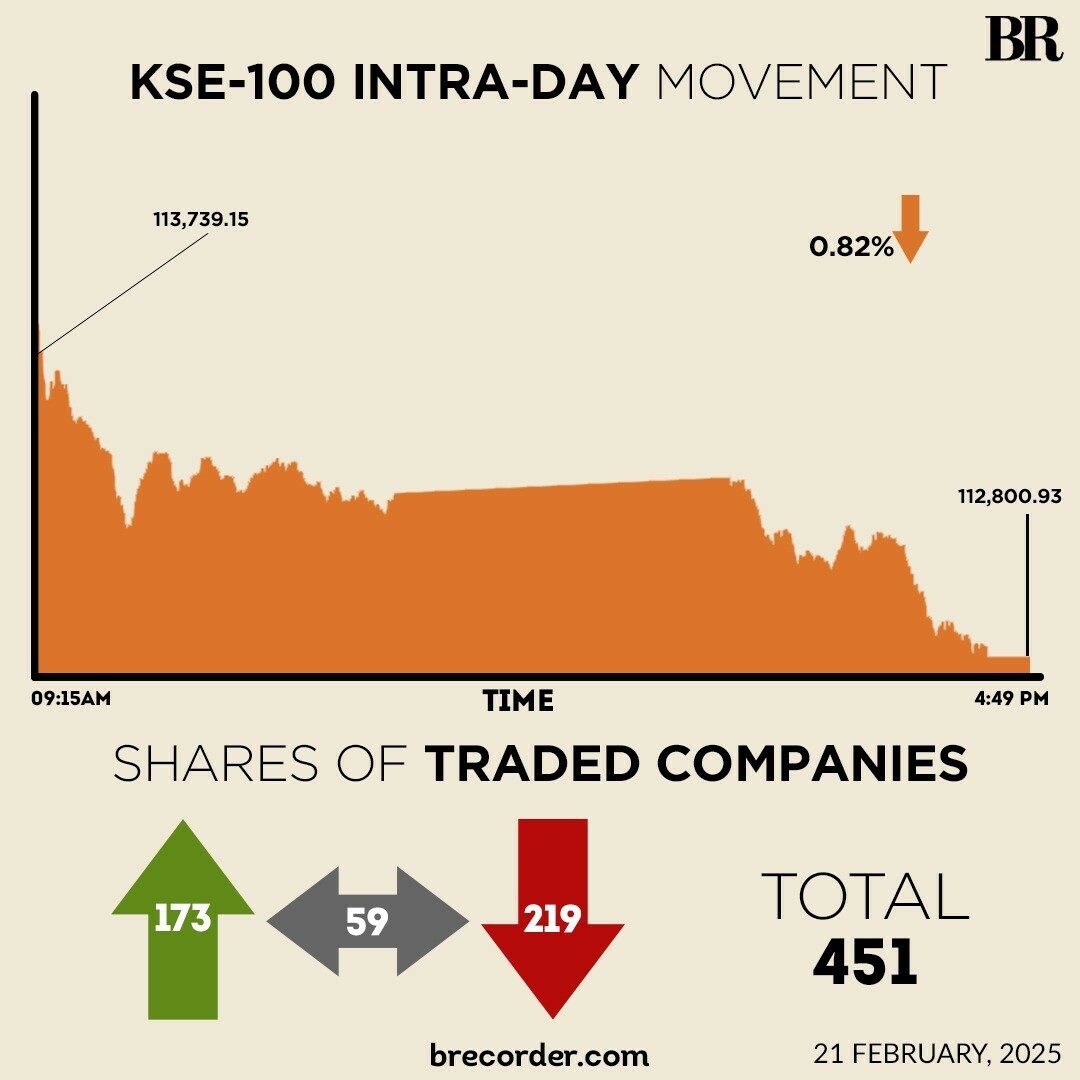

However, the latter hours witnessed selling pressure that pushed the index to an intra-day low of 112,813.87.

At close, the benchmark index settled at 112,800.93, down by 938.23 points or 0.82%.

“Market opened on a positive note led by LUCK PA, as the company through a notice to exchange announced a stock split where shareholders will get 5 share for every 1 share held. However, profit taking was observed in the second half of trading session, as investors came in to book their profit the weekend,” brokerage house Topline Securities said in its post-market report.

In a key development, it was learnt that an International Monetary Fund (IMF) mission will arrive in Islamabad next week to discuss around $1 billion in climate financing for Pakistan.

Khurram Schehzad, adviser to the country’s finance minister, told Reuters on Thursday that the mission would visit from February 24 to 28 for a “review and discussion” of climate resilience funding.

On Thursday, the KSE-100 gained nearly 400 points to settle at 113,739.16.

The index closed the week on a flat note (up by meager 0.63%), where investors kept a close eye on December quarter result announcements, Topline said.

Internationally, Asian shares rose on Friday, reversing Wall Street’s negative lead as the U.S. exceptionalism narrative continued to lose its shine, while once unloved Chinese stocks found themselves more buyers thanks to optimism over artificial intelligence (AI).

Gold hovered near a record high and was set to extend its gains for an eighth consecutive week, helped by safe-haven flows due to concerns over Donald Trump’s tariff threats and amid contentious talks as the US President pushes for a quick deal to end the Russia-Ukraine war.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.8% in the early Asian session, boosted by a jump in Hong Kong-listed stocks.

Hong Kong’s Hang Seng Index advanced 1.8% shortly after the open, while tech shares surged 2.5%.

Similarly, China’s CSI300 blue-chip index gained 0.2%, with the CSI big data index rising 2%.

Chinese stocks have been on a tear in recent days, driven by DeepSeek’s AI breakthrough that reignited investor interest in China’s technology capabilities.

While the Hang Seng Tech Index has gained 26% for the year thus far, the S&P 500 is up just 4% over the same period.

Meanwhile, the Pakistani rupee recorded a marginal decline against the US dollar, depreciating 0.04% in the inter-bank market on Friday. At close, the rupee settled at 279.57, a loss of Re0.11 against the greenback.

Volume on the all-share index decreased to 455.39 million from 787.44 million recorded in the previous close.

The value of shares declined to Rs21.52 billion from Rs33.10 billion in the previous session.

Pak Int.Bulk was the volume leader with 35.41 million shares, followed by K Electric Ltd with 24.74 million shares, and GhaniGlobalGlass with 19.83 million shares.

Shares of 451 companies were traded on Friday, of which 173 registered an increase, 219 recorded a fall, while 59 remained unchanged.