Buying momentum continued at the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index closing with a gain of over 1,900 points on Monday amid improved market sentiment following stable macroeconomic indicators.

Buying interest was observed throughout the trading session, pushing the benchmark index to an intra-day high of 161,881.45.

At close, the KSE-100 settled at 161,538.40, an increase of 1,945.50 points or 1.22%.

“The rally was underpinned by renewed investor confidence after the Economic Coordination Committee (ECC) approved a comprehensive inter-corporate circular debt settlement plan,” brokerage house Topline Securities said in its post-market report.

ECC approves Rs659.65bn govt guarantee for circular debt financing

“Adding to the momentum, the ECC also sanctioned Rs660 billion in sovereign guarantees for Rs1.225 trillion in commercial loans to address circular debt, alongside approving the diversion of gas supplies to fertilizer plants – developments that spurred broad-based buying across key sectors.”

Index-heavy stocks including ENGROH, FFC, EFERT, OGDC, and PPL were among the major gainers, collectively contributing 1,243 points to the benchmark. On the flip side, PSEL, UBL, AGP, and MEBL together shaved off 199 points, Topline said.

Pakistan posted a budget surplus of Rs 2.1 trillion, equal to 1.6% of GDP, during the first quarter (July-September) of the current fiscal year, said a document of the Finance Division.

Meanwhile, Topline Securities, in its latest report, projected that the benchmark KSE-100 Index would reach 203,000 points by December 2026, implying a total return of around 26%, including a 7% dividend yield.

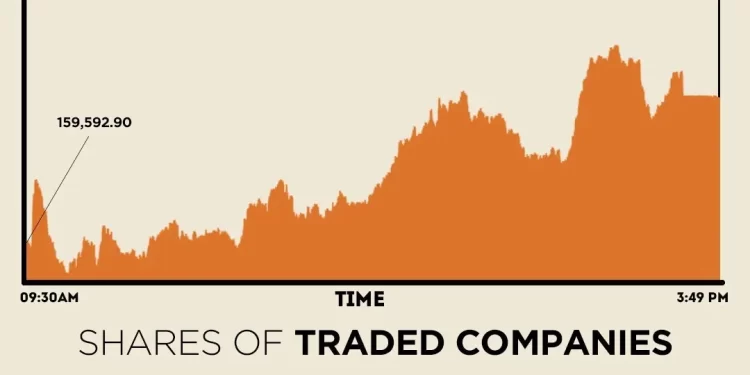

During the previous week, the PSX endured a lacklustre performance as persistent geopolitical uncertainty and weak macroeconomic indicators kept investor sentiment under pressure. The benchmark KSE-100 Index declined by 2,038 points or 1.3% on a week-on-week basis to settle at 159,592.91 points.

Internationally, global shares rose on Monday on optimism that an end to the historic US government shutdown was in sight, while the dollar was nursing losses from last week.

The US Senate on Sunday moved forward on a measure aimed at reopening the federal government and ending a now 40-day shutdown that has sidelined federal workers, delayed food aid and snarled air travel.

The breakthrough helped push Nasdaq futures up 1.2% while S&P 500 futures rose 0.7%. EUROSTOXX 50 futures and DAX futures were up more than 1% each, while FTSE futures gained 0.85%.

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 1% and Japan’s Nikkei advanced 0.97%.

If the Senate eventually passes the bill, the package must still be approved by the House of Representatives and sent to President Donald Trump for his signature, a process that could take several days.

The shutdown has taken a growing toll on the US economy, with federal workers from airports to law enforcement and the military going unpaid while the central bank flies blind with limited government reporting of economic data.

In China, the CSI300 blue-chip index was down 0.24%, while Hong Kong’s Hang Seng Index rose 0.6%.

Meanwhile, the Pakistani rupee registered marginal gain against the US dollar in the inter-bank market on Monday. At close, the currency settled at 280.81, a gain of Re0.01 against the greenback.

Volume on the all-share index increased to 783.29 million from 768.83 million recorded in the previous close. The value of shares rose to Rs36.37 billion from Rs30.73 billion in the previous session.

F. Nat.Equities was the volume leader with 73.71 million shares, followed by Kohinoor Spining with 54.81 million shares, and Bank Makramah with 49.12 million shares.

Shares of 477 companies were traded on Monday, of which 292 registered an increase, 136 recorded a fall, and 49 remained unchanged.