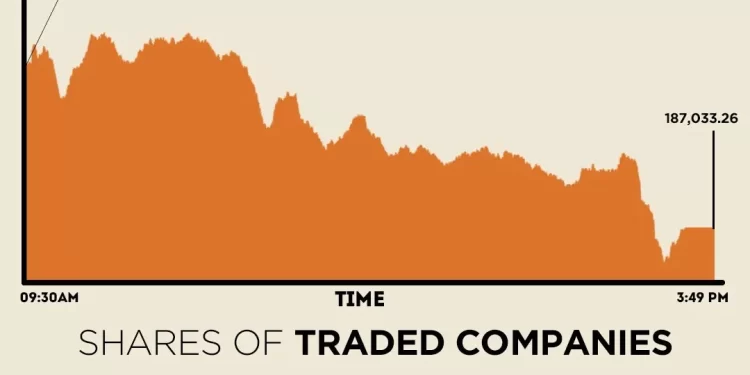

After days of positive momentum, selling pressure returned at the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index shedding nearly 1,600 points on Wednesday.

The market kicked off trading relatively firm and briefly attempted to move higher, hitting an intra-day high of 189,523.43.

However, it failed to hold gains as selling pressure gripped the bourse for most of the trading session. The selling intensified during the final hours of trading, pushing the benchmark index to an intra-day low of 186,626.85.

At close, the KSE-100 Index settled at 187,033.26, a decrease of 1,588.52 points or 0.84%.

“The local bourse witnessed a bout of profit booking as investors sought to maximize recent gains, leading to a volatile trading session,” brokerage house Topline Securities said in its post-market report.

Select index heavyweights—PPL, SAZEW, and NBP—provided some respite, collectively contributing 135 points to the index. However, selling pressure in MEBL, ENGROH, MCB, HBL, and SYS outweighed these gains, cumulatively shaving 792 points off the benchmark, it added.

In a key development, repatriation of profits and dividends by foreign investors rose sharply 27% in the first half of the current fiscal year (FY26), highlighting stronger earnings outflows from Pakistan. The State Bank of Pakistan (SBP) on Tuesday reported that foreign companies operating in the country repatriated $1.559 billion in profits and dividends during July-December of FY26 compared to $1.226 billion in the same period last year (FY25).

On Tuesday, the PSX concluded trading on a positive note as benchmark indices extended gains amid sustained investor participation. The KSE-100 Index advanced by 860.09 points, or 0.46%, to close at 188,621.78 points.

Globally, Asian stocks extended their losses for a third session on Wednesday, undone by heightened tensions over US threats to acquire Greenland ahead of President Donald Trump’s Davos speech, while a global bond rout appeared to slow for now.

Fears of offshore selling of US assets – the so-called “Sell America” trade that emerged after last year’s “Liberation Day” tariff announcements in April – gripped markets as Wall Street tumbled over 2% overnight and the US dollar suffered its biggest fall in over a month.

That sent investors fleeing to the safety of gold and silver, which both notched record highs.

Trump, however, doubled down on his rhetoric over Greenland, saying there was “no going back” on his goal to control the island, refusing to rule out taking it by force. His threat of tariffs on Europe has also rekindled fears of a global trade war.

The European Union will convene an emergency summit in Brussels on Thursday to discuss the matter, with the long-standing US-EU alliance clearly at risk.

All eyes are now on the World Economic Forum in Davos where Trump is due to deliver a speech on Wednesday.

In early trade, MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.3%. Japan’s Nikkei slumped 1.2%, down for the fifth straight day.

Meanwhile, the Pakistani rupee registered marginal gain against the US dollar in the inter-bank market on Wednesday. At close, the local currency settled at 279.90, a gain of Re0.01 against the greenback.

Volume on the all-share index increased to 1,325.60 million from 1,225.81 million recorded in the previous close. The value of shares rose to Rs69.58 billion from Rs63.90 billion in the previous session.

K-Electric Ltd was the volume leader with 263.24 million shares, followed by Hascol Petrol with 100.76 million shares, and Fauji Foods Ltd with 74.97 million shares.

Shares of 488 companies were traded on Wednesday, of which 118 registered an increase, 331 recorded a fall, and 39 remained unchanged.