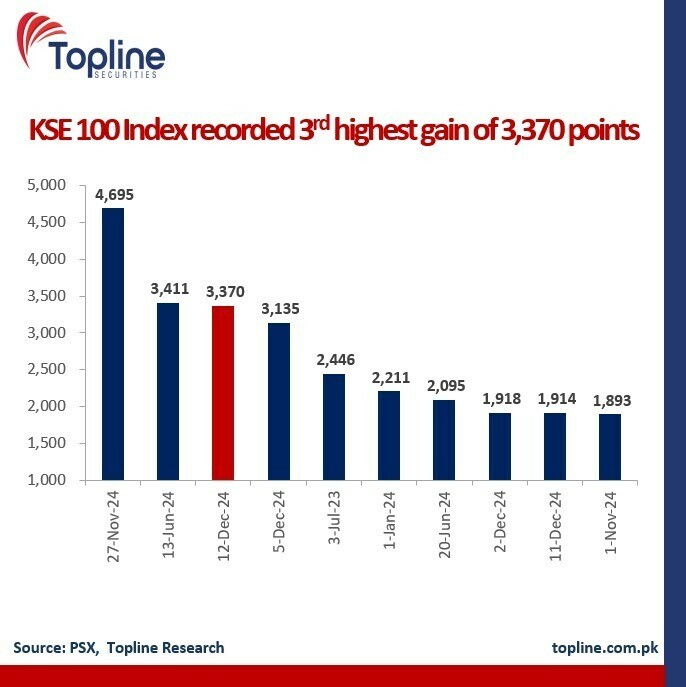

Records continued to tumble at the Pakistan Stock Exchange (PSX) as the benchmark KSE-100 Index settled well above 114,000, marking a new all-time high after a gain of 3,370 points on Thursday.

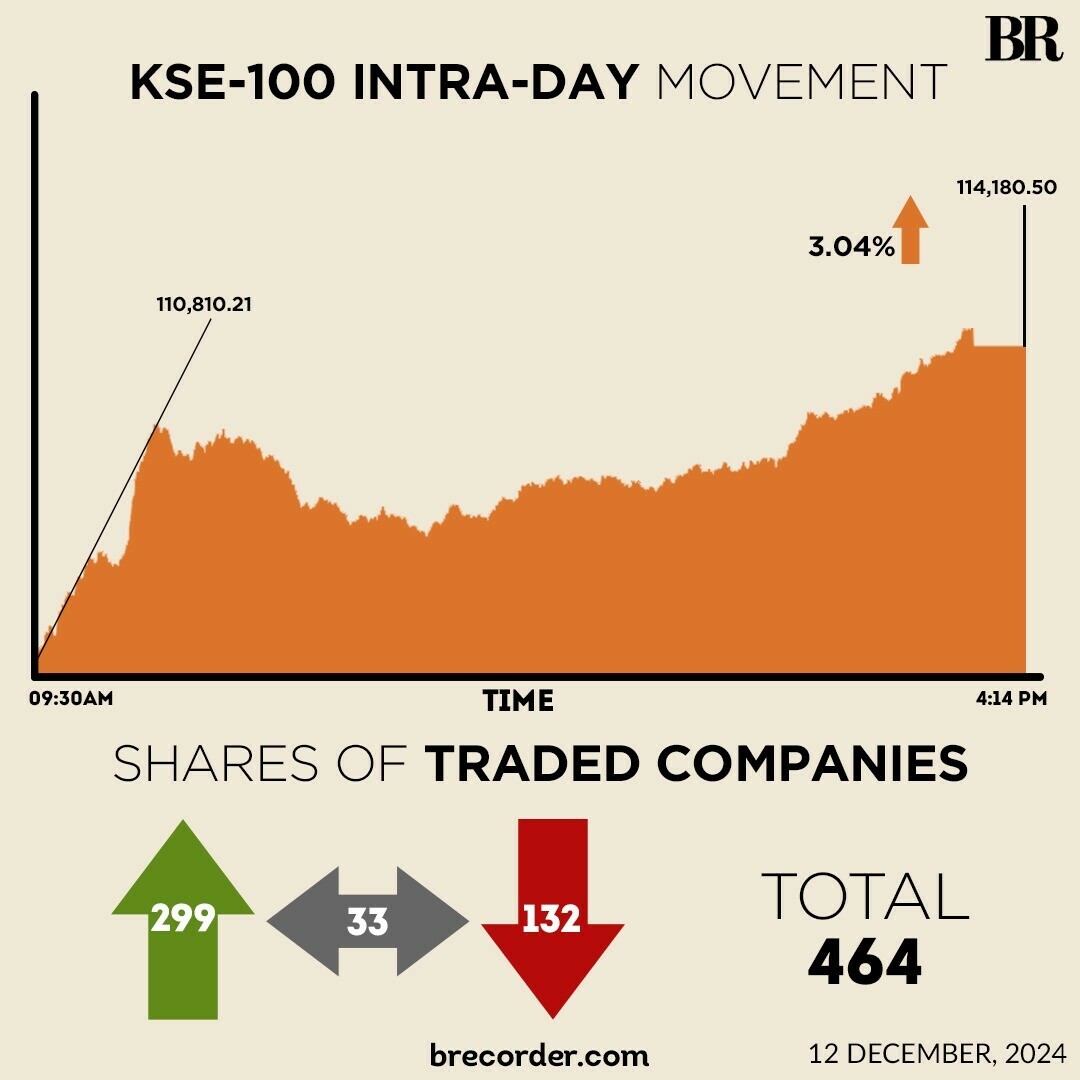

Buying momentum persisted throughout the trading session, driving the KSE-100 to an intra-day high of 114,408.62.

At close, the benchmark index settled at 114,180.50, an increase of 3,370.29 points or 3.04%.

The bullish momentum, which saw the KSE-100 Index rise from levels around 40,000 in June 2023, has recently been fuelled by a slowing pace of inflation.

The KSE-100 posted its 3rd highest gain of 3,370 points on Thursday, Mohammed Sohail, CEO of Topline Securities, said.

“Remarkably, 9 of the top 10 largest gains have been recorded in 2024,” he said.

On Thursday, across-the-board buying was seen in key sectors including automobile assemblers, cement, commercial banks, oil and gas exploration companies, OMCs, power generation and refineries. Index-heavy stocks including HUBCO, SSGC, SNGP, PPL, OGDC, MARI, ENGRO, HBL, MCB and NBP traded in the green.

“Cooling off on the political landscape on the backdrop of the government and a opposition party [PTI] agreed [reportedly] on unconditional dialogues to resolve issues and further decline in the yields in yesterday’s T-bills auction were two significant catalyst of the massive showdown at the PSX,” Ali Najib from Insight Securities said in a report on Thursday.

Experts have attributed the momentum to multiple factors, including robust economic indicators, and recovery in global equities on receding geopolitical tensions.

“From 40k to 112k in just 18 months – a stellar 180% return,” Mohammed Sohail said in a note earlier in the session.

“This marks the best comeback in Pakistan stock market’s 75-year history, tripling in value and showcasing unmatched resilience,” he added.

Market participants are also monitoring the upcoming Monetary Policy Committee (MPC) meeting scheduled for December 16, with a widespread expectation of a significant interest rate cut.

In a key development, the Asian Development Bank (ADB) revised upward Pakistan’s GDP growth projection for fiscal year 2025, raising it to 3% from 2.8%, while the inflation forecast was revised downward to 10% from 15% in FY24.

On Wednesday, equities posted a strong recovery supported by healthy buying activity from local investors. The KSE-100 Index increased by 1,913.57 points, or 1.76%, to close at a new peak of 110,810.22 points.

Globally, Asian stocks gained on Thursday, tracking Wall Street’s tech-led rally overnight after an as-expected reading of U.S. consumer inflation cemented bets for a Federal Reserve interest-rate cut next week.

Japan’s Nikkei topped 40,000 for the first time since mid-October, led by advances in chip-sector shares. The exporter-heavy index also got a boost from a weakening yen, as traders pared bets for a Bank of Japan rate hike next week.

The tech-heavy Nikkei jumped 1.5% as of 0202 GMT, while the broader Topix climbed 1.2%.

South Korea’s KOSPI added 0.7%, while Taiwan’s benchmark gained 1%.

Hong Kong’s Hang Seng advanced by 0.4%, and mainland blue chips advanced by 0.2%.

Overnight, the tech-focused Nasdaq shot up 1.8% to close above 20,000 for the first time, while the S&P 500 climbed 0.8%.

Meanwhile, the Pakistani rupee saw a marginal decline against the US dollar, depreciating 0.02% in the inter-bank market on Thursday. At close, the currency settled at 278.23 for a loss of Re0.06 against the greenback.

Volume on the all-share index increased to 1,469.56 million from 1,080.02 million on Wednesday.

The value of shares jumped to Rs67.28 billion from Rs47.14 billion in the previous session.

WorldCall Telecom was the volume leader with 232.92 million shares, followed by Cnergyico PK with 80.19 million shares, and Pak Int.Bulk with 70.68 million shares.

Shares of 464 companies were traded on Thursday, of which 299 registered an increase, 132 recorded a fall, while 33 remained unchanged.