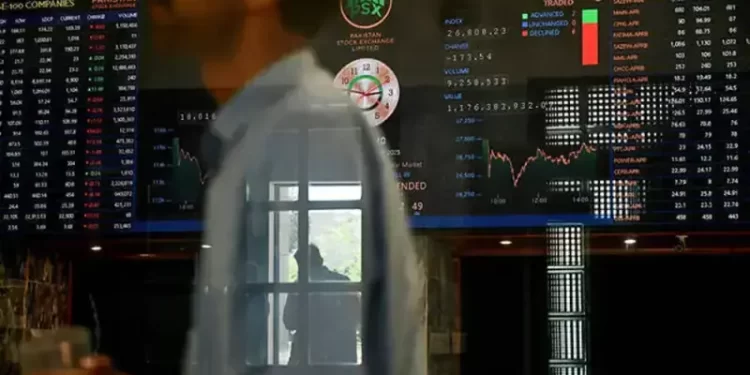

Buying rally continued unabated at the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index closing above the 163,000 level, for the first time in history during trading on Monday.

Buying momentum persisted throughout the trading session, driving the KSE-100 to an intra-day high of 163,903.62.

At close, the benchmark index settled at 163,847.68, an increase of 1,590.68 points or 0.98%.

The rally comes as an International Monetary Fund (IMF) mission, led by Pakistan Mission Chief Iva Petrova, is in Islamabad to discuss the second review under the Extended Fund Facility (EFF) and the first review of the Resilience and Sustainability Facility (RSF).

Later in the day, talks between the Ministry of Finance (MoF) and the IMF began in Islamabad, with Finance Minister Muhammad Aurangzeb chairing the session of discussions with the visiting mission.

During the previous week, the PSX extended its record-setting rally, with the benchmark KSE-100 Index closing at an all-time high of 162,257 points, up 4,220 points or 2.67% on a week-on-week basis.

The surge was largely driven by strong gains in exploration and production, power and banking sectors, supported by positive developments on the economic and political fronts.

Internationally, most share markets rose in Asia on Monday while the dollar eased as investors braced for a possible shutdown of the US government, which would in turn delay publication of the September payrolls report and a raft of other key data.

President Donald Trump will meet with the top Democratic and Republican leaders in Congress later on Monday to discuss extending government funding. Without a deal, a shutdown would begin from Wednesday, which is also when new US tariffs on heavy trucks, pharmaceuticals and other items go into effect.

A protracted closure could leave the Federal Reserve flying blind on the economy when it meets on October 29.

Meanwhile, markets imply a 90% chance of a Fed cut in October, with around a 65% probability of another in December.

S&P 500 futures were up 0.2%, while Nasdaq futures firmed 0.3%, having eased modestly last week. EUROSTOXX 50 futures added 0.3%, as did FTSE futures and DAX futures.

Japan’s Nikkei slipped 0.8%, but was still 5% higher for September so far. Investors are waiting to see who will emerge as the new leader of the ruling LDP in a vote this weekend, with implications for fiscal and monetary policy.

South Korean stocks bounced 1.3%, bringing their gains for the month to 7.6%.

MSCI’s broadest index of Asia-Pacific shares outside Japan firmed 0.4%, to be up almost 4% for the month.

On Monday, the Pakistani rupee strengthened against the US dollar, appreciating 0.01% in the inter-bank market. At close, the currency settled at 281.35, a gain of Re0.02 against the greenback.

Volume on the all-share index decreased to 1,285 million from 1,714 million recorded in the previous close. The value of shares decreased to Rs65.77 billion from Rs70.74 billion in the previous session.

WorldCall Telecom was the volume leader with 118.94 million shares, followed by K-Electric Ltd with 78.20 million shares, and Hascol Petrol with 63.52 million shares.

Shares of 482 companies were traded on Monday, of which 235 registered an increase, 216 recorded a fall, while 31 remained unchanged.