Pakistan’s economic growth is expected to strengthen in FY2026 as macroeconomic stability broadens through continued reform to address structural weaknesses. However, the recent floods may decelerate this growth, said the Asian Development Bank (ADB) in its latest Asian Development Outlook (ADO), September 2025, released on Tuesday.

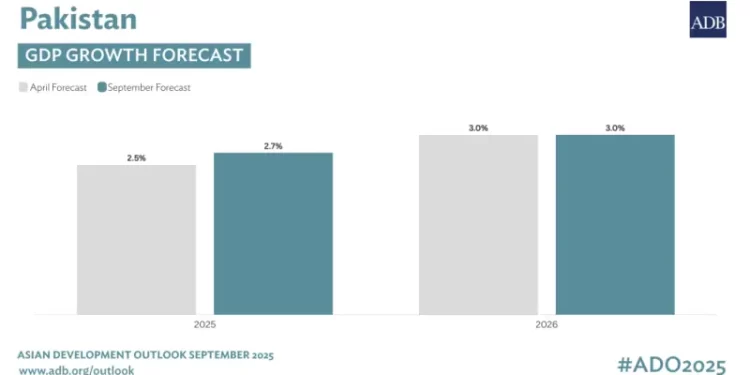

The Manila-based lender said that Pakistan’s growth accelerated in FY2025, while its forecast for 2026 remains unchanged.

“The economy grew by 2.7% in FY2025 as investment increased, attracted by stable macroeconomic conditions and ongoing policy reform. Growth came primarily from industry and services, while bad weather affected agriculture.

“The FY2026 growth forecast remains unchanged at 3.0%, reflecting the expectation that economic performance will be buoyed by continued reform to address structural weaknesses,” ADB said.

In its latest outlook, ADB noted that while a boost to economic activity is expected from the rapid easing of risks tied to debt and the balance of payments —“as seen in the upgrade of Pakistan’s sovereign credit ratings by global credit rating agencies, as well as renewed business confidence spurred by a recent US-Pakistan trade agreement”— the damage caused to infrastructure and farmland during the recent floods may decelerate growth.

PM Shehbaz urges IMF to factor flood impact into review

Floods in Pakistan have ravaged the country, threatening fresh food inflation and creating deeper hardship in the cash-strapped South Asian nation.

However, recovery and rehabilitation efforts following the floods, supported by fiscal incentives for construction announced in the FY2026 budget, may partly offset their adverse impact on growth, read the ADO.

“Pakistan’s growth prospects remain positive,” said the ADB Country

Director for Pakistan Emma Fan.

“However, the country continues to face structural challenges, compounded by recurring disasters such as the recent floods. In this context, consistent reforms and policy implementation are essential for reinforcing policy credibility, sustaining economic momentum, and enhancing the country’s resilience.”

Inflation projection

ADB projected inflation rate at 6% in FY2026, within the central bank’s target range of 5%–7%, but slightly higher than earlier forecasts, “reflecting the impact of flood-induced supply chain disruption on food prices and increased gas tariffs effective on 1 July 2025”.

External sector

Meanwhile, Pakistan’s external sector is expected to remain stable over the medium term, said ADB, with reserves expected to reach $17.7 billion by June 2026, providing 2.8 months of import cover.

“[However,] export growth is expected to remain subdued by flood-related disruption to rice and cotton production. However, improved liquidity— driven by faster tax refunds and lower production costs under supportive monetary conditions—may help offset the impact of reduced agricultural output.

“Additionally, the recent US-Pakistan trade agreement will alleviate uncertainty, sustaining trade and investment flows between the two countries,” read the report.

On the other hand, imports are expected to grow faster as food imports increase to address flood-induced shortages and raw material imports increase because of the expected recovery in manufacturing, thereby widening the trade deficit, the report noted.

Key risks

According to ADB, Pakistan’s economic outlook faces several downside risks from policy slippage and climate change.

“Failure to meet revenue and fiscal consolidation targets, or delays in implementing critical reforms, remain top concerns,” it said, whereas policy slippage could weaken business confidence, raise borrowing costs, and increase external financing risks.

Moreover, Pakistan remains vulnerable to extreme weather and natural hazards like floods, which could reverse last year’s decline in food price inflation, disrupt economic activity, and strain household incomes.

Global geopolitical risks could also negatively affect inflation, external stability, and business confidence, it said.

On the upside, quicker reform execution and a favourable external environment could strengthen business confidence, pushing growth above current expectations, the ADO read.