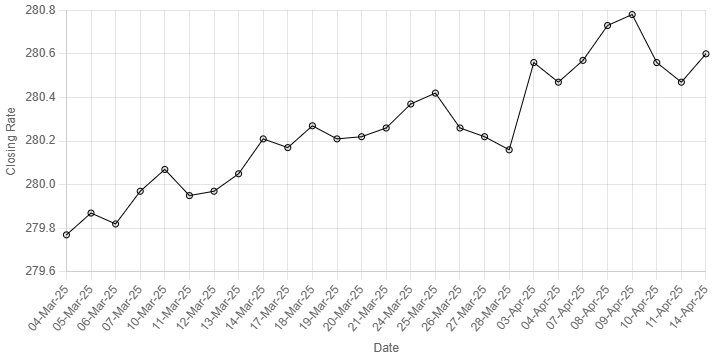

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee saw slight decline against the US dollar, depreciating 0.05% in the inter-bank market on Monday.

At close, the currency settled at 280.60, a loss of Re0.13 against the US dollar.

During the previous week, the Pakistani rupee remained stable against the US dollar in the inter-bank market.

The rupee lost Re0.31 in the first three sessions of the week, but gained momentum to appreciate by the same in the last two sessions.

Resultantly, the local unit closed at Rs280.47, unchanged from the rate against the greenback it had closed at during the week earlier, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar drifted lower on Monday as an early bump off a three-year low fizzled, with markets spooked by the stream of tariff-related pronouncements from US President Donald Trump that last week shook investor confidence in the world’s reserve currency.

Investors braced for another volatile week as Trump’s imposition and then abrupt postponement of tariffs on goods imported to the US continued to sow confusion.

The dollar reversed early gains as the Asian trading session got under way, falling against the Swiss franc towards a 10-year trough hit on Friday.

The dollar last traded 0.05% lower against the Swiss franc at 0.8158.

Against the yen, the dollar fell 0.62% to 142.62.

Oil prices, a key indicator of currency parity, edged up on Monday after Chinese data showed a sharp rebound in crude imports in March, although concerns that the escalating trade war between the United States and China would weaken global economic growth and dent fuel demand weighed.

Brent crude futures gained 6 cents, or 0.09%, to $64.82 a barrel at 0632 GMT.

US West Texas Intermediate crude futures were trading at $61.59 a barrel, up 9 cents, or 0.15%.

Inter-bank market rates for dollar on Monday

BID Rs 280.60

OFFER Rs 280.80

Open-market movement

In the open market, the PKR lost 5 paise for buying and gained 4 paise for selling against USD, closing at 280.20 and 282.06, respectively.

Against Euro, the PKR lost 1.85 rupee for buying and 1.69 rupee for selling, closing at 317.91 and 321.08, respectively.

Against UAE Dirham, the PKR lost 9 paise for buying and gained 1 paisa for selling, closing at 76.20 and 76.97, respectively.

Against Saudi Riyal, the PKR gained 3 paise for buying and 2 paise for selling, closing at 74.43 and 75.16, respectively.

Open-market rates for dollar on Monday

BID Rs 280.20

OFFER Rs 282.06

American Dollar Exchange Rate

American Dollar Exchange Rate