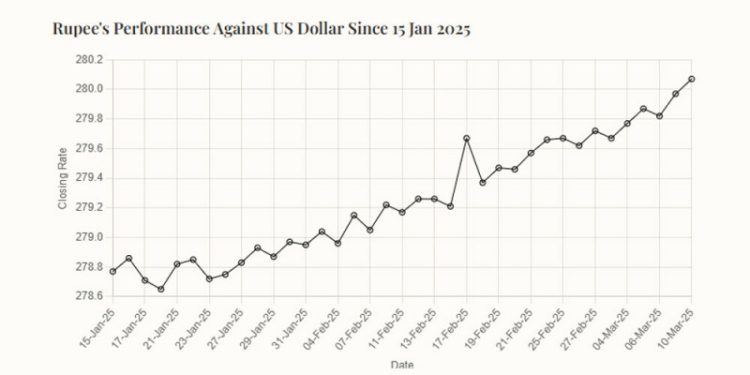

Rupee’s Performance Against US Dollar Since 15 Jan 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“15-Jan-25”, “16-Jan-25”, “17-Jan-25”, “20-Jan-25”, “21-Jan-25”, “22-Jan-25”, “23-Jan-25”,

“24-Jan-25”, “27-Jan-25”, “28-Jan-25”, “29-Jan-25”, “30-Jan-25”, “31-Jan-25”, “03-Feb-25”,

“04-Feb-25”, “06-Feb-25”, “07-Feb-25”, “10-Feb-25”, “11-Feb-25”, “12-Feb-25”, “13-Feb-25”,

“14-Feb-25”, “17-Feb-25”, “18-Feb-25”, “19-Feb-25”, “20-Feb-25”, “21-Feb-25”, “24-Feb-25”, “25-Feb-25”, “26-Feb-25”, “27-Feb-25”, “28-Feb-25”, “04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

278.77, 278.86, 278.71, 278.65, 278.82, 278.85, 278.72, 278.75,

278.83, 278.93, 278.87, 278.97, 278.95, 279.04, 278.96, 279.15,

279.05, 279.22, 279.17, 279.26, 279.26, 279.21, 279.67, 279.37,

279.47, 279.46, 279.57, 279.66, 279.67, 279.62, 279.72, 279.67, 279.77, 279.87, 279.82, 279.97, 280.07

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee recorded marginal decline against the US dollar, depreciating 0.04% or Re0.10 in the inter-bank market on Monday, closing a session at over 280 against the greenback after more than a year.

The last time the rupee closed below 280 against the US dollar was in January 2024.

During the previous week, the rupee maintained its gradual downturn as it lost Re0.30 or 0.11% in the inter-bank market.

The local unit closed at 279.97, against 279.67 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar began Monday on a weak note after significant losses last week due to a potentially weakening US labour market, while concerns over a global trade war led investors to safe havens, lifting the yen and the Swiss franc.

Markets have been fixated on simmering trade tensions across the world as US President Donald Trump slapped tariffs on top trading partners only to delay some of them for a month amid growing signs and fears of the US economy slowing down.

That has led to investors losing faith in the US economy which has been outperforming its peers. On currency futures markets, investors have slashed net long dollar positions to $15.3 billion from a nine-year high of $35.2 billion in late January.

That left the US dollar index, which measures the US currency against six others, at 103.59 on Monday, stuck near a four-month low touched last week.

The US dollar fell more than 3% last week against major rivals, clocking its weakest weekly performance since November 2022 as investors fret about tariffs and their impact on the economy.

Adding to investor jitters, Trump in a Fox News interview on Sunday declined to predict whether the US could face a recession amid stock market concerns about his tariff actions on Mexico, Canada and China.

Oil prices, a key indicator of currency parity, Oil prices fell on Monday as concern about the impact of US import tariffs on global economic growth and fuel demand, as well as rising output from OPEC+ producers, cooled investor appetite for riskier assets.

Brent crude fell 6 cents to $70.30 a barrel by 0720 GMT after settling up 90 cents on Friday.

US West Texas Intermediate crude was at $66.96 a barrel, down 8 cents after closing 68 cents higher in the previous trading session.

Inter-bank market rates for dollar on Monday

BID Rs280.06

OFFER Rs280.26

Open-market movement

In the open market, the PKR lost 3 paise for buying and 2 paise for selling against USD, closing at 279.28 and 281.49, respectively.

Against Euro, the PKR lost 50 paise for buying and 60 paise for selling, closing at 302.10 and 305.26, respectively.

Against UAE Dirham, the PKR lost 1 paisa for buying and remained unchanged for selling, closing at 76.12 and 76.70, respectively.

Against Saudi Riyal, the PKR lost 9 paise for buying and remained unchanged for selling, closing at 74.49 and 75.00, respectively.

Open-market rates for dollar on Monday

BID Rs279.28

OFFER Rs281.49