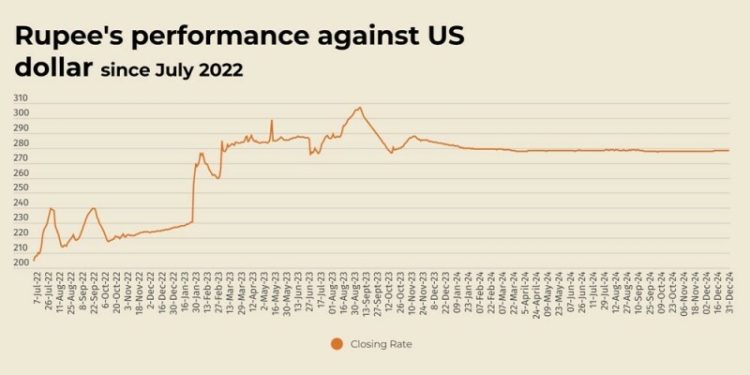

The Pakistani rupee concluded the final session of the calendar year on a negative note against the US dollar, depreciating 0.03% in the inter-bank market on Tuesday.

At close, the currency settled at 278.55 for a loss of Re0.07 against the greenback.

The rupee settled at 278.48 on Monday, according to the State Bank of Pakistan (SBP).

During the calendar year, the rupee appreciated 1.2% against the US dollar.

“The PKR appreciation of 1.2% stems from a strong external position, marked by a current account surplus of $646 million in 11MCY24, compared to a deficit of $1.1 billion in the same period last year,” said Arif Habib Limited (AHL), in a note.

“Higher remittances and a rise in SBP’s reserves to $11.9 billion from $8.2 billion in Dec’23 have also supported.

“Additionally, narrowed the gap between interbank and open market rates too contributed to the currency’s stability”

Internationally, the US dollar was firm on the last trading day of the year, poised to clock strong gains in 2024 against most currencies as investors prepared for fewer US rate cuts and the incoming Trump administration’s policies.

The US dollar’s ascent, buoyed by rising Treasury yields, has pushed the yen toward its lowest levels since July, when the Japanese authorities last intervened. On Tuesday, it was at 157.02 per US dollar, on course for a 10% drop in 2024, its fourth straight year of decline against the dollar.

That has left the US dollar index, which measures the US currency versus six other major units, at 108.06, not far from the two-year high it touched this month.

The index has risen 6.6% in 2024 as traders cut back on bets of deep rate cuts next year.

The Federal Reserve shocked markets earlier this month by cutting their interest-rate forecast for 2025 to 50 basis points of cuts, from 100 basis points, wary of stubbornly high inflation.

Oil prices, a key indicator of currency parity, rose on Tuesday after data showed China’s manufacturing activity expanded in December, but they are on track to end lower for a second consecutive year due to demand concerns in top consuming countries.

Brent crude futures rose 60 cents, or 0.8%, to $74.59 a barrel as of 0530 GMT.

US West Texas Intermediate crude gained 62 cents, or 0.9%, to $71.61 a barrel.

For the year, Brent declined 3.2%, while WTI was down 0.1%.

Inter-bank market rates for dollar on Tuesday

BID Rs 278.55

OFFER Rs 278.75

Open-market movement

In the open market, the PKR gained 14 paise for buying but lost 5 paise for selling against USD, closing at 277.75 and 279.59, respectively.

Against Euro, the PKR gained 63 paise for buying and 57 paise for selling, closing at 288.57 and 290.93, respectively.

Against UAE Dirham, the PKR gained 1 paisa for buying and remained unchanged for selling, closing at 75.59 and 76.10, respectively.

Against Saudi Riyal, the PKR remained unchanged for both buying and selling, closing at 73.88 and 74.35, respectively.

Open-market rates for dollar on Tuesday

BID Rs 277.75

OFFER Rs 279.59