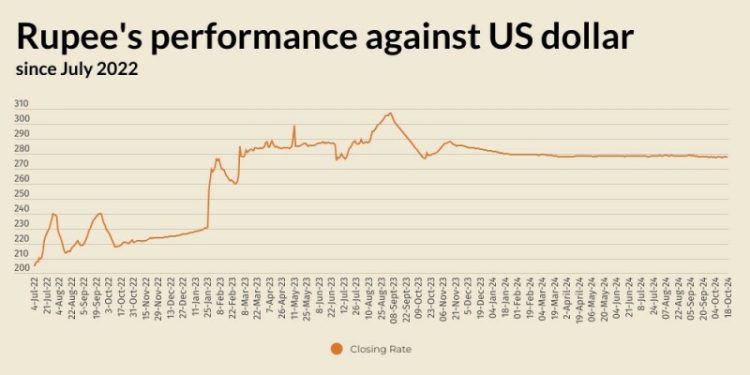

The Pakistani rupee recorded marginal improvement against the US dollar, appreciating 0.06% in the inter-bank market on Friday.

At close, the currency settled at 277.61, a gain of Re0.18 against the greenback.

On Thursday, the rupee had settled at 277.79, according to the State Bank of Pakistan (SBP).

In a key development, foreign exchange reserves held by the SBP increased by $215 million on a weekly basis, clocking in at $11.02 billion to hit 2.5-year high as of October 11, 2024, data released on Thursday showed.

Globally, the US dollar was headed for its third weekly gain in a row on Friday, helped by a dovish European Central Bank and strong US data that is pushing out expectations for how fast US rates can fall, particularly if Donald Trump wins the presidency.

The greenback pared some of those gains and last bought 149.93 yen on Friday.

Data on Thursday showed US retail sales growth was higher than expected and the ECB cut interest rates by 25 basis points.

Meanwhile, markets have been disappointed at the lack of detail offered by Chinese authorities on plans to revive the slowing economy, and the yuan is headed for its largest weekly fall in more than 13 months against a resilient dollar.

Oil prices, a key indicator of currency parity, steadied on Friday after data showed a fall in crude and fuel inventories in the United States and the emergence of more fiscal stimulus to boost China’s economy, though prices were headed for their biggest weekly loss in more than a month.

Brent crude futures gained 23 cents, or 0.3%, to $74.68 a barrel by 0840 GMT, while US West Texas Intermediate crude was at $70.96 a barrel, up 29 cents, or 0.4%.

Brent and WTI are set to fall about 6% this week, their biggest weekly decline since Sept. 2, after OPEC and the International Energy Agency cut their forecasts for global oil demand in 2024 and 2025.

Inter-bank market rates for dollar on Friday

BID Rs 277.61

OFFER Rs 277.81

Open-market movement

In the open market, the PKR gained 16 paise for buying and lost 2 paise for selling against USD, closing at 277.60 and 279.13, respectively.

Against Euro, the PKR gained 56 paise for buying and 45 paise for selling, closing at 299.19 and 301.98, respectively.

Against UAE Dirham, the PKR gained 5 paise for buying and 2 paise for selling, closing at 75.22 and 75.95, respectively.

Against Saudi Riyal, the PKR gained 4 paise for buying and 6 paise for selling, closing at 73.42 and 74.06, respectively.

Open-market rates for dollar on Friday

BID Rs 277.60

OFFER Rs 279.13