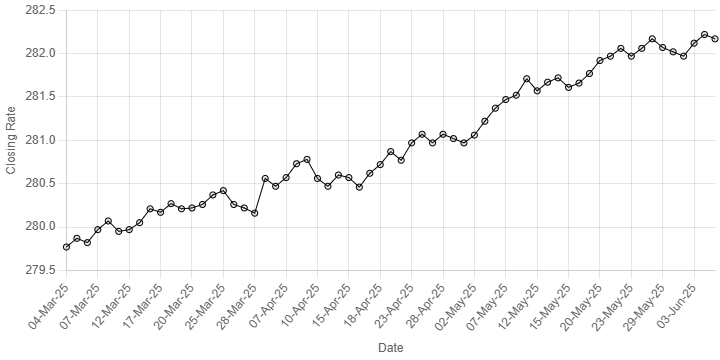

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee saw marginal improvement against the US dollar, appreciating 0.02% in the inter-bank market on Thursday.

At close, the local currency settles at 282.17, a gain of Re0.05 against the greenback.

On Wednesday, the Pakistani rupee closed the day at 282.22.

Internationally, the US dollar softened on Thursday, stuck near six-week lows after weak US economic data revived fears of slow growth and high inflation, while the euro was steady ahead of an expected interest rate cut from the European Central Bank.

The soft data, which showed US services sector contracted for the first time in nearly a year in May and an easing labour market, led to a rally in Treasuries, with the yield on the US 10-year Treasury note hovering at four-week lows.

The dollar was a tad lower against the yen at 142.80, while the euro stood at $1.1424, not far from the six-week high it touched at the start of the week. Sterling last fetched $1.3557.

Markets have been rattled since US President Donald Trump announced a slate of tariffs on countries around the globe on April 2, only to pause some and declare new ones, leading investors to look for alternatives to US assets.

The dollar weakness has been the story of the year, with foreign exchange strategists surveyed by Reuters expecting further declines on mounting concerns about the US federal deficit and debt.

The dollar index, which measures the US currency against six others, was at 98.749 and has dropped about 9% this year, poised for its weakest yearly performance since 2017.

Oil prices, a key indicator of currency parity, slipped on Thursday after a build in US gasoline and diesel inventories and cuts to Saudi Arabia’s July prices for Asian crude buyers, with global economic uncertainty also weighing on prices.

Brent crude futures fell 14 cents, or 0.2%, to $64.72 a barrel at 0500 GMT.

US West Texas Intermediate crude lost 24 cents, or 0.4%, dropping to $62.61 a barrel.

Inter-bank market rates for dollar on Thursday

BID Rs 282.17

OFFER Rs 282.37

Open-market movement

In the open market, the PKR lost 3 paise for buying and 2 paise for selling against USD, closing at 282.34 and 284.40, respectively.

Against Euro, the PKR lost 85 paise for buying and 89 paise for selling, closing at 320.95 and 324.67, respectively.

Against UAE Dirham, the PKR lost 1 paisa for buying and remained unchanged for selling, closing at 76.64 and 77.45, respectively.

Against Saudi Riyal, the PKR lost 2 paise for buying and 1 paisa for selling, closing at 74.80 and 75.61, respectively.

Open-market rates for dollar on Thursday

BID Rs 282.34

OFFER Rs 284.40