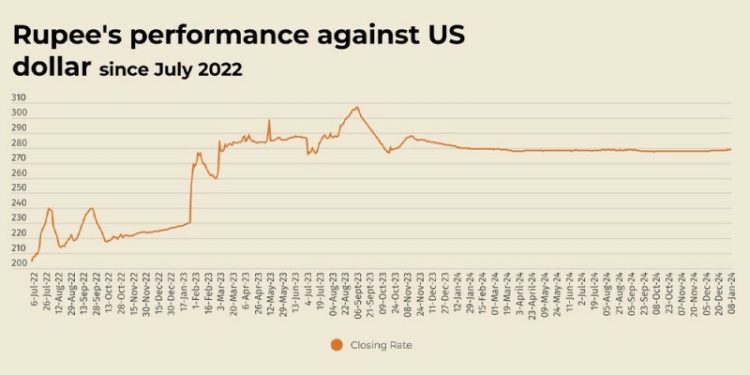

The Pakistani rupee recorded a marginal decline against the US dollar, depreciating 0.02% in the inter-bank market on Wednesday.

At close, the currency settled at 278.72 for a loss of Re0.05 against the greenback.

The rupee settled at 278.67 on Tuesday, according to the State Bank of Pakistan (SBP).

Globally, the US dollar stood tall on Wednesday and the yen sagged close to levels that drew intervention last year after strong US data drove a spike in yields and pared some bets on Federal Reserve rate cuts.

Traders have a wary eye on US labour data due on Friday and on inauguration day on Jan. 20, when Donald Trump is expected to begin his second U.S. presidency with a flurry of policy announcements and executive orders.

Overnight data showed US job openings unexpectedly rose in November, layoffs were low, while services sector activity accelerated in December and a measure of prices paid for inputs hit a two-year high – a possible inflation warning.

Bond markets reacted by sending 10-year yields up more than eight basis points to touch an eight-month high of 4.699%, while the 30-year yield rose 7.4 bps and is less than nine bps from breaching 5%.

Traders price only about 37 bps of easing through this year, according to LSEG data derived from rates futures.

The US dollar followed suit and the contrast between the solid US economy and weak data in Australia and New Zealand has the Antipodean currencies plumbing multi-year lows.

Oil prices, a key indicator of currency parity, rose on Wednesday as supplies from Russia and OPEC members tightened while US crude oil stocks fell last week, market sources said, citing American Petroleum Institute figures.

Also supporting prices was an unexpected increase in US job openings pointed to expanding economic activity and consequent growth in oil demand. Brent crude was up 69 cents, or 0.90%, at $77.74 a barrel at 0954 GMT.

US West Texas Intermediate crude climbed 87 cents, or 1.17%, to $75.12.

Inter-bank market rates for dollar on Wednesday

BID Rs 278.72

OFFER Rs 278.92

Open-market movement

In the open market, the PKR lost 8 paise for buying and 17 paise for selling against USD, closing at 278.46 and 280.24, respectively.

Against Euro, the PKR gained 1.91 rupee for buying and 1.55 rupee for selling, closing at 287.27 and 290.11, respectively.

Against UAE Dirham, the PKR lost 2 paise for buying and 5 paise for selling, closing at 75.77 and 76.30, respectively.

Against Saudi Riyal, the PKR lost 3 paise for buying and 6 paise for selling, closing at 74.06 and 74.55, respectively.

Open-market rates for dollar on Wednesday

BID Rs 278.46

OFFER Rs 280.24