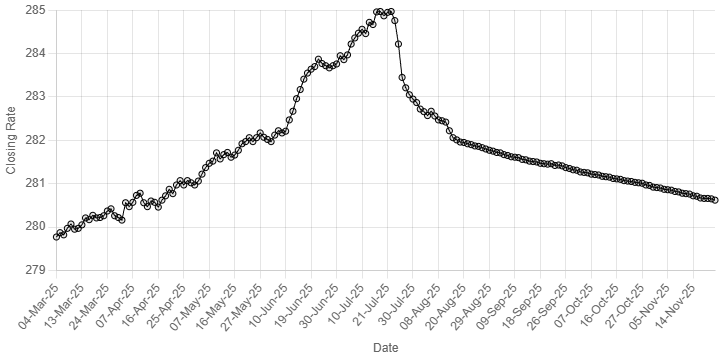

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”, “13-Jun-25”, “16-Jun-25”, “17-Jun-25”, “18-Jun-25”, “19-Jun-25”, “20-Jun-25”, “23-Jun-25”, “24-Jun-25”, “25-Jun-25”, “26-Jun-25”, “27-Jun-25”, “30-Jun-25”, “02-Jul-25”, “03-Jul-25”, “04-Jul-25”, “07-Jul-25”, “08-Jul-25”, “09-Jul-25”, “10-Jul-25”, “11-Jul-25”, “14-Jul-25”, “15-Jul-25”, “16-Jul-25”, “17-Jul-25”, “18-Jul-25”, “21-Jul-25”, “22-Jul-25”, “23-Jul-25”, “24-Jul-25”, “25-Jul-25”, “28-Jul-25”, “29-Jul-25”, “30-Jul-25”, “31-Jul-25”, “01-Aug-25”, “04-Aug-25”, “05-Aug-25”, “06-Aug-25”, “07-Aug-25”, “08-Aug-25”, “11-Aug-25”, “12-Aug-25”, “13-Aug-25”, “15-Aug-25”, “18-Aug-25”, “19-Aug-25”, “20-Aug-25”, “21-Aug-25”, “22-Aug-25”, “25-Aug-25”, “26-Aug-25”, “27-Aug-25”, “28-Aug-25”, “29-Aug-25”, “01-Sep-25”, “02-Sep-25”, “03-Sep-25”, “04-Sep-25”, “05-Sep-25”, “08-Sep-25”, “09-Sep-25”, “10-Sep-25”, “11-Sep-25”, “12-Sep-25”, “15-Sep-25”, “16-Sep-25”, “17-Sep-25”, “18-Sep-25”, “19-Sep-25”, “21-Sep-25”, “22-Sep-25”, “23-Sep-25”, “24-Sep-25”, “25-Sep-25”, “26-Sep-25”, “29-Sep-25”, “30-Sep-25”, “01-Oct-25”, “02-Oct-25”, “03-Oct-25”, “06-Oct-25”, “07-Oct-25”, “08-Oct-25”, “09-Oct-25”, “10-Oct-25”, “13-Oct-25”, “14-Oct-25”, “15-Oct-25”, “16-Oct-25”, “17-Oct-25”, “20-Oct-25”, “21-Oct-25”, “22-Oct-25”, “23-Oct-25”, “24-Oct-25”, “27-Oct-25”, “28-Oct-25”, “29-Oct-25”, “30-Oct-25”, “31-Oct-25”, “03-Nov-25”, “04-Nov-25”, “05-Nov-25”, “06-Nov-25”, “07-Nov-25”, “10-Nov-25”, “11-Nov-25”, “12-Nov-25”, “13-Nov-25”, “14-Nov-25”, “17-Nov-25”, “18-Nov-25”, “19-Nov-25”, “20-Nov-25”, “21-Nov-25”, “24-Nov-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67, 282.96, 283.17, 283.41, 283.55, 283.64, 283.70, 283.87, 283.77, 283.72, 283.67, 283.72, 283.76, 283.95, 283.86, 283.97, 284.22, 284.36, 284.47, 284.56, 284.46, 284.72, 284.67, 284.96, 284.97, 284.87, 284.95, 284.97, 284.76, 284.22, 283.45, 283.21, 283.05, 282.95, 282.87, 282.72, 282.66, 282.57, 282.67, 282.56, 282.47, 282.45, 282.42, 282.22, 282.06, 282.01, 281.96, 281.95, 281.92, 281.90, 281.87, 281.86, 281.83, 281.8, 281.77, 281.75, 281.72, 281.71, 281.67, 281.65, 281.62, 281.61, 281.60, 281.56, 281.55, 281.52, 281.51, 281.50, 281.47, 281.46, 281.45, 281.46, 281.42, 281.43, 281.41, 281.37, 281.35, 281.32, 281.31, 281.27, 281.26, 281.25, 281.22, 281.21, 281.20, 281.17, 281.16, 281.15, 281.12, 281.11, 281.10, 281.07, 281.06, 281.05, 281.03, 281.02, 281.01, 280.97, 280.96, 280.92, 280.91, 280.90, 280.87, 280.86, 280.85, 280.82, 280.81, 280.78, 280.77, 280.76, 280.72, 280.71, 280.67, 280.66, 280.66, 280.65, 280.62, 280.61

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee recorded marginal improvement against the US dollar in the inter-bank market on Monday.

At close, the currency settled at 280.61, a gain of Re0.01 against the greenback.

During the previous week, the Pakistan rupee posted marginal gain as it appreciated by Re0.10 or 0.04% against the US dollar in the inter-bank market.

The local unit closed at 280.62, against 280.72 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar was steady and traders were wary on Monday as intervention risks swirled around the yen, with the gilt market on edge ahead of a British budget in a holiday-interrupted week where a New Zealand policy meeting is also expected to deliver a rate cut.

A holiday in Tokyo lightened trade in Asia and left the yen drifting lower at 156.71 per dollar in the early morning.

Japan’s currency has been sliding on a combination of its low interest rate and looser fiscal policies, but it bounced from 10-month lows late last week when Finance Minister Satsuki Katayama ramped up verbal warnings of official yen buying.

Traders see intervention looming somewhere between 158 and 162 yen per dollar, with Thanksgiving-thinned trade later in the week a possible window for authorities to step in.

Japan can actively intervene in the currency market to mitigate the negative economic impact of a weak yen, Takuji Aida, a private-sector member of a key government panel, said in a television programme on public broadcaster NHK on Sunday.

Elsewhere, the euro was held in check at $1.1506, without much of a boost despite a resurgence in wagers on a US rate cut in December.

The dollar index was steady at 100.25, and other majors were held fairly close to recent lows.

Oil prices, a key indicator of currency parity, stabilised on Monday after last week’s decline of about 3%, as investors weighed the chances for a US rate cut against the prospect of a Ukraine peace deal that could lead to an easing of sanctions on major producer Russia.

The United States and Ukraine sought on Monday to narrow the gaps in a peace plan to end the Russian war in Ukraine after agreeing to modify a US proposal that Kyiv and its European allies saw as too favourable to Moscow.

Brent crude futures inched 6 cents lower to $62.50 per barrel by 1421 GMT, while West Texas Intermediate was down 3 cents to $58.03 a barrel.

Inter-bank market rates for dollar on Monday

BID Rs 280.61

OFFER Rs 280.80

Open-market movement

In the open market, the PKR gained 1 paisa for buying and remained unchanged for selling against USD, closing at 281.28 and 281.65, respectively.

Against Euro, the PKR gained 43 paise for buying and 38 paise for selling, closing at 323.67 and 326.57, respectively.

Against UAE Dirham, the PKR lost 3 paise for buying and remained unchanged for selling, closing at 76.65 and 77.39, respectively.

Against Saudi Riyal, the PKR lost 3 paise for both buying and selling, closing at 74.97 and 75.55, respectively.

Open-market rates for dollar on Monday

BID Rs 281.28

OFFER Rs 281.65

American Dollar Exchange Rate

American Dollar Exchange Rate