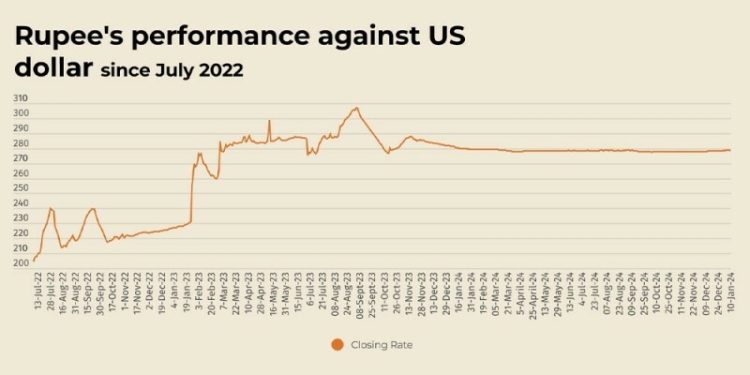

The Pakistani rupee remained largely stable against the US dollar, appreciating 0.01% in the inter-bank market on Friday.

At close, the currency settled at 278.58 after a gain of Re0.03 against the greenback.

The rupee closed at 278.61 on Thursday, according to the State Bank of Pakistan (SBP).

Globally, the US dollar looked set to extend its longest weekly winning streak in over a year on Friday, underpinned by rising bond yields and expectations of another strong set of US jobs numbers.

The US dollar has gained 0.5% on the yen this week to buy 158.03 yen and added more than 1% on an ailing British pound, which was battered to a 14-month low in tandem with a selloff in gilts and concern about British finances.

The US dollar is set for a broadly steady week on the euro, which buys $1.0926 and it has notched small gains on the Australian and New Zealand dollars.

The US dollar index is set for a sixth consecutive weekly gain, its longest run since an 11-week streak in 2023 as the US economy continues to seem strong in contrast with weaknesses elsewhere.

The index was steady in the Asia morning on Friday for a 0.25% weekly rise to 109.18.

Markets have already scaled back expectations to around 40 basis points of US rate cuts for 2025, while concerns about President-elect Donald Trump’s potentially inflationary agenda have helped drive up longer-term yields.

Oil prices, a key indicator of currency parity, rose on Friday and were on track for a third straight week of gains as traders focused on potential supply disruptions from sanctions while icy conditions in parts of the United States and Europe are expected to drive up fuel demand.

Brent crude futures gained $1.06 cents, or 1.4%, to $77.98 a barrel by 0904 GMT.

US West Texas Intermediate crude futures advanced $1.04 cents, or 1.4%%, to $74.96.

Over the three weeks to Jan. 10, Brent has climbed by close to 7% while WTI has jumped nearly 8%.

Inter-bank market rates for dollar on Friday

BID Rs 278.58

OFFER Rs 278.78

Open-market movement

In the open market, the PKR remained unchanged for both buying and selling

against USD, closing at 278.59 and 280.18, respectively.

Against Euro, the PKR gained 5 paise for buying and 3 paise for selling, closing at 286.46 and 289.17, respectively.

Against UAE Dirham, the PKR lost 3 paise for buying and 5 paise for selling, closing at 75.79 and 76.30, respectively.

Against Saudi Riyal, the PKR remained unchanged for buying and lost 5 paise for selling, closing at 74.08 and 74.55, respectively.

Open-market rates for dollar on Friday

BID Rs 278.59

OFFER Rs 280.18