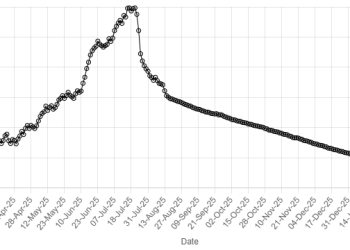

The Pakistani rupee remained largely stable against the US dollar on Wednesday, depreciating 0.02% in the inter-bank market.

At close, the currency settled at 277.85, a loss of Re0.05 against the US dollar.

On Tuesday, the rupee had settled at 277.80, according to the State Bank of Pakistan (SBP).

Amid high expectations, the International Monetary Fund (IMF) Executive Board is all set to consider Pakistan’s 37-month Extended Fund Facility Arrangement (EFF) of about $7 billion on Wednesday (today).

Globally, the Australian and New Zealand dollars scaled multi-month peaks on Wednesday while the yuan hit its strongest level in more than a year, as China’s aggressive stimulus package provided the latest shot in the arm for risk appetite.

Markets globally were basking in the afterglow of China’s latest slew of support measures announced on Tuesday ranging from outsized rate cuts to aid for its stock market, in a move that encouraged investors.

In line with its broad easing measures, the People’s Bank of China on Wednesday also lowered the cost of its medium-term loans to banks to 2.00% from 2.30%.

Oil prices, a key indicator of currency parity, were little changed on Wednesday as investors reassessed the ability of China’s stimulus plans to boost its economy, while declining US crude oil and fuel stockpiles provided support.

Brent crude futures were down 8 cents, or 0.1%, at $75.09 a barrel at 0844 GMT. US West Texas Intermediate crude was down 13 cents, or 0.2%, at $71.43 per barrel.

Prices rose by about 1.7% on Tuesday after China announced its most aggressive economic stimulus since the COVID-19 pandemic, with interest rate cuts and government funding.

Inter-bank market rates for dollar on Wednesday

BID Rs 277.85

OFFER Rs 278.05

Open-market movement

In the open market, the PKR gained 20 paise for buying and 12 paise for

selling against USD, closing at 278.86 and 280.33, respectively.

Against Euro, the PKR lost 188 rupee for buying and 1.84 rupee for selling, closing at 309.42 and 312.23, respectively.

Against UAE Dirham, the PKR lost 9 paise for buying and 3 paise for selling, closing at 75.45 and 76.11, respectively.

Against Saudi Riyal, the PKR lost 9 paise for buying and 4 paise for selling, closing at 73.70 and 74.32, respectively.

Open-market rates for dollar on Wednesday

BID Rs 278.86

OFFER Rs 280.33

American Dollar Exchange Rate

American Dollar Exchange Rate