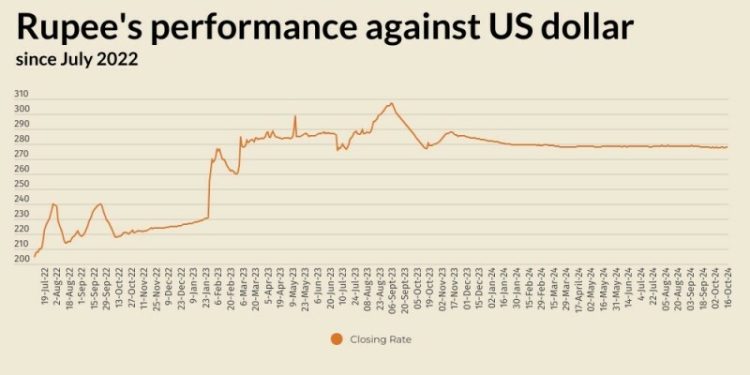

The Pakistani rupee recorded a marginal decline against the US dollar, depreciating 0.04% in the inter-bank market on Wednesday.

At close, the currency settled at 277.84, a loss of Re0.10 against the greenback.

On Tuesday, the rupee had settled at 277.74, according to the State Bank of Pakistan (SBP).

Globally, the Australian and New Zealand dollars slumped on Wednesday as scepticism grew about top trading partner China’s stimulus, while the greenback hovered near two-month peaks versus major peers on wagers US interest rate cuts will be gradual.

The US dollar index, which measures the currency against six major rivals, was steady at 103.25, sticking close to Monday’s high of 103.61, a level previously not seen since Aug. 8.

Recent data indicating a resilient economy coupled with slightly hotter-than-expected inflation in September has led traders to trim bets for aggressive Federal Reserve easing.

Traders currently lay about 94% odds for a 25 basis-point cut when the Fed next decides policy on Nov. 7, with about 6% probability of no change, according to CME Group’s FedWatch Tool.

Atlanta Federal Reserve President Raphael Bostic said he has pencilled in just one more interest rate reduction of 25 basis points this year. Investors are pricing two 25 bps rate cuts this year .

Oil prices, a key indicator of currency parity, steadied on Wednesday, supported by OPEC+ cuts and uncertainty over what may happen next in the Middle East conflict, although an outlook for ample supply next year added downward pressure.

Crude fell more than 4% to a near two-week low on Tuesday in response to a weaker demand outlook and after a media report said Israel would not strike Iranian nuclear and oil sites, easing fears of supply disruptions.

Brent crude oil futures rose 16 cents, or 0.2%, to $74.41 a barrel by 0930 GMT.

Inter-bank market rates for dollar on Wednesday

BID Rs 277.84

OFFER Rs 278.04

Open-market movement

In the open market, the PKR gained 1 paisa for buying and lost 3 paise

for selling against USD, closing at 277.84 and 279.28, respectively.

Against Euro, the PKR lost 4 paise for buying and gained 2 paise for selling, closing at 300.77 and 303.55, respectively.

Against UAE Dirham, the PKR remained unchanged for both buying and selling, closing at 75.27 and 75.97, respectively.

Against Saudi Riyal, the PKR remained unchanged for both buying and selling, closing at 73.47 and 74.10, respectively.

Open-market rates for dollar on Wednesday

BID Rs 277.84

OFFER Rs 279.28