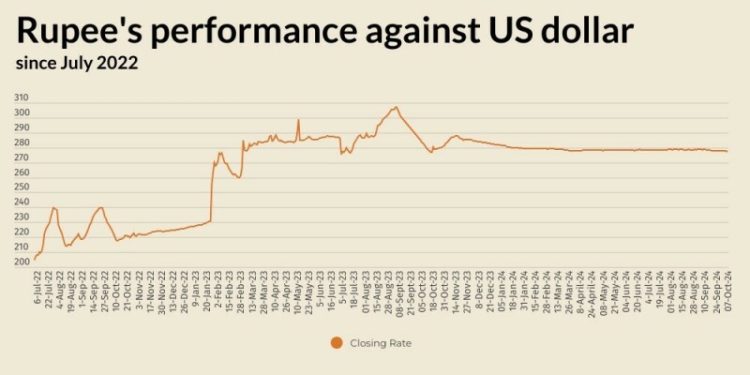

The Pakistani rupee registered a marginal fall against the US dollar, depreciating 0.04% in the inter-bank market on Monday.

At close, the currency settled at 277.64, a loss of Re0.12 against the greenback.

During the previous week, the rupee made further improvement as it gained Re0.12 or 0.04% against the US dollar.

The local unit closed at 277.52, against 277.64 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

The currency market is now seen as being stable after the Executive Board approved the fresh bailout programme with the International Monetary Fund (IMF), and the subsequent receipt of the first tranche.

Internationally, the US dollar extended a rally sparked by Friday’s strong U.S. jobs data and an escalation in the Middle East conflict.

The US dollar’s gains followed a US jobs report that showed the biggest jump in jobs in six months in September, a drop in the unemployment rate and solid wage rises, all pointing to a resilient economy and forcing markets to reduce pricing for Federal Reserve rate cuts.

Market expectations have swung to the extreme for the Federal Reserve to do just a 25 bps cut in November, rather than 50 bps, following the jobs data. They now price in a 98% chance of a quarter-point cut, up from 47% a week ago, and a 2% chance of no cut at all, according to CME’s FedWatch tool.

The dollar index measure against major peers was flat. It rose 0.5% on Friday to a seven-week high, logging more than 2% gains for the week, its biggest in two years.

Oil prices, a key indicator of currency parity, extended gains on Monday, with Brent nearing $80 to build on last week’s steepest weekly jump since early 2023, driven by fears of a wider Middle East conflict and potential disruption to exports from the major oil-producing region.

Brent crude futures rose $1.11, or 1.4%, to $79.16 a barrel by 0839 GMT.

US West Texas Intermediate crude futures jumped $1.28, or 1.7%, to $75.66.

Brent climbed by more than 8% last week while WTI soared by 9.1% on the possibility that Israel could strike Iranian oil infrastructure in response to an Iran’s Oct. 1 missile attack on Israel.

The Pakistani rupee registered a marginal fall against the US dollar, depreciating 0.04% in the inter-bank market on Monday.

At close, the currency settled at 277.64, a loss of Re0.12 against the greenback.

During the previous week, the rupee made further improvement as it gained Re0.12 or 0.04% against the US dollar.

The local unit closed at 277.52, against 277.64 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

The currency market is now seen as being stable after the Executive Board approved the fresh bailout programme with the International Monetary Fund (IMF), and the subsequent receipt of the first tranche.

Internationally, the US dollar extended a rally sparked by Friday’s strong U.S. jobs data and an escalation in the Middle East conflict.

The US dollar’s gains followed a US jobs report that showed the biggest jump in jobs in six months in September, a drop in the unemployment rate and solid wage rises, all pointing to a resilient economy and forcing markets to reduce pricing for Federal Reserve rate cuts.

Market expectations have swung to the extreme for the Federal Reserve to do just a 25 bps cut in November, rather than 50 bps, following the jobs data. They now price in a 98% chance of a quarter-point cut, up from 47% a week ago, and a 2% chance of no cut at all, according to CME’s FedWatch tool.

The dollar index measure against major peers was flat. It rose 0.5% on Friday to a seven-week high, logging more than 2% gains for the week, its biggest in two years.

Oil prices, a key indicator of currency parity, extended gains on Monday, with Brent nearing $80 to build on last week’s steepest weekly jump since early 2023, driven by fears of a wider Middle East conflict and potential disruption to exports from the major oil-producing region.

Brent crude futures rose $1.11, or 1.4%, to $79.16 a barrel by 0839 GMT.

US West Texas Intermediate crude futures jumped $1.28, or 1.7%, to $75.66.

Brent climbed by more than 8% last week while WTI soared by 9.1% on the possibility that Israel could strike Iranian oil infrastructure in response to an Iran’s Oct. 1 missile attack on Israel.

American Dollar Exchange Rate

American Dollar Exchange Rate