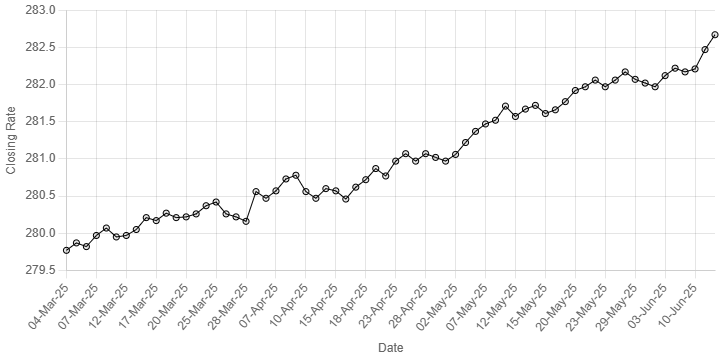

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee weakened against the US dollar, depreciating 0.07% on Thursday.

At close, the local currency settled at 282.67, a loss of Re0.20 against the greenback.

On Wednesday, the rupee settled at Rs282.47 against the US dollar.

Internationally, the US dollar slid on Thursday on further signs that US President Donald Trump may adopt a softer stance in tariff negotiations and heightened expectations of Federal Reserve rate cuts.

Trump said on Wednesday he would be willing to extend a July 8 deadline for completing trade talks with countries before higher US tariffs are imposed.

US Treasury Secretary Scott Bessent suggested earlier that the Trump administration may offer extensions from a July trade deal deadline for countries negotiating in good faith.

The remarks renewed dollar weakness, lifting the euro to a seven-week high. It last bought $1.1525.

The greenback lost 0.43% against the yen and 0.34% against the Swiss franc to last trade at 143.98 and 0.81725, respectively.

Against a basket of currencies, the dollar fell to its weakest since April 22 at 98.327.

Oil prices, a key indicator of currency parity, eased on Thursday, reversing gains made earlier in the Asian trading session, as market participants assessed a US decision to move personnel from the Middle East ahead of talks with Iran over the latter’s nuclear-related activity.

Brent crude futures were down 73 cents, or 1.1%, to $69.04 a barrel at 0901 GMT, while US West Texas Intermediate crude was 66 cents, or 1%, lower at $67.49 a barrel.

A day earlier, both Brent and WTI surged more than 4% to their highest since early April.

Inter-bank market rates for dollar on Thursday

BID Rs 282.67

OFFER Rs 282.87

Open-market movement

In the open market, the PKR lost 27 paise for buying and 18 paise for selling against USD, closing at 283.05 and 284.82, respectively.

Against Euro, the PKR lost 3.06 rupee for buying and 3.51 rupee for selling, closing at 324.94 and 328.84, respectively.

Against UAE Dirham, the PKR lost 24 paise for buying and 21 paise for selling, closing at 76.96 and 77.69, respectively.

Against Saudi Riyal, the PKR lost 25 paise for buying and 22 paise for selling, closing at 75.25 and 75.97, respectively.

Open-market rates for dollar on Thursday

BID Rs 283.05

OFFER Rs 284.82

American Dollar Exchange Rate

American Dollar Exchange Rate