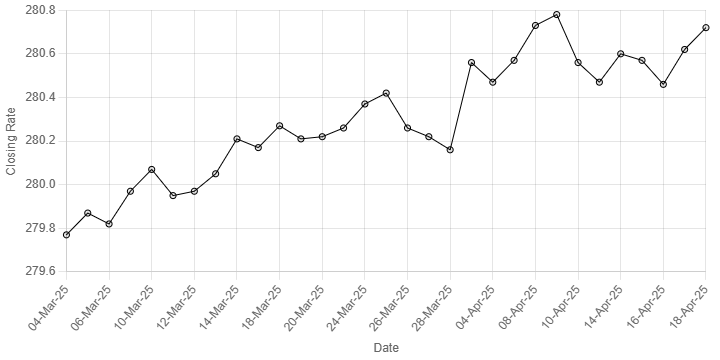

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee posted marginal decline against the US dollar, depreciating 0.03% during trading in the inter-bank market on Friday.

At close, the local currency settled at 280.72 against greenback, a loss of Re0.10 as compared to the previous day close.

On Thursday, the rupee had closed at 280.62 against the greenback.

Internationally, the US dollar rallied on Thursday after its recent weakness across peer currencies appeared exhausted for the time being, while the euro weakened slightly after the European Central Bank cut rates for the seventh time in a year.

The greenback has largely stabilized this week and held within a tight range against the single currency, following large drops last week that were prompted by concerns over the economic impact of tariffs and investors shifting investments overseas.

“We’ve had a pretty impressive run of strength for most of the G10 currencies and so I think we’re just in a bit of a pause phase right now,” said Eric Theoret, FX strategist at Scotiabank. “Our medium-term views still bearish for the US dollar, so we’re just seeing this as a bit of a consolidation.”

Traders are closely watching discussions between the United States and trading partners for signs of a deal that may offer some clarity on the objectives of the Trump administration.

Oil prices, a key indicator of currency parity, rose to the highest in two weeks on Thursday after the United States imposed new sanctions to curb Iranian oil exports, elevating supply concerns.

Brent crude futures rose $1.74, or 2.64%, to $67.59 a barrel by 11:30 a.m. EDT (1530 GMT), and US West Texas Intermediate crude was at $64.27 a barrel, up $1.80, or 2.88%. Both benchmarks settled 2% higher on Wednesday at their highest levels since April 3 and are on track for their first weekly rise in three weeks. Thursday is the last settlement day of the week ahead of the Easter holidays and trade volumes are expected to be thin.

Sanctions issued by President Donald Trump’s administration on Wednesday, including against a China-based “teapot” oil refinery, ramp up pressure on Tehran amid talks on the country’s nuclear programme.