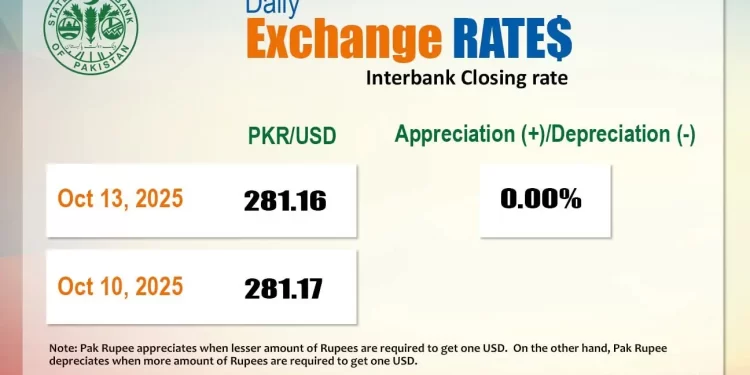

The Pakistani rupee posted marginal gain against the US dollar in the inter-bank market on Monday.

At close, the local currency settled at 281.16, up by Re0.01 against the previous session’s close of 281.17, according to State Bank of Pakistan (SBP) data.

During the previous week, the Pakistan rupee posted marginal gain for another week as it appreciated by Re0.09 or 0.03% against the US dollar in the inter-bank market.

Internationally, the US dollar recovered from a selloff in early trade on Monday as investors hoped Washington may temper its latest escalation of the trade war with Beijing, while political developments in France and Japan undermined the euro and the yen.

The dollar index, which measures the greenback’s strength against a basket of six currencies, edged higher to 99.002, retracing some losses sustained after US President Trump announced 100% tariffs on China.

That revived fears of Trump’s Liberation Day rollout of sweeping tariffs in April, sparking a selloff in stocks and cryptocurrencies on Friday.

Against the yen, the dollar fetched 151.985 yen, up 0.5% as markets assessed the path ahead for new Liberal Democratic Party leader Sanae Takaichi after Komeito quit the ruling coalition on Friday, dealing a blow to her hopes to become the first female prime minister of the world’s fourth largest economy.

The euro stood at $1.1609, down 0.1%, after the French presidency announced Prime Minister Sebastien Lecornu’s new cabinet line-up on Sunday, reappointing Roland Lescure, a close ally of Emmanuel Macron, as finance minister.

Oil prices, a key indicator of currency parity, clawed back some gains on Monday after hitting five-month lows in the previous session as investors hoped potential talks between the presidents of the US and China could ease trade tensions between the world’s two largest economies and oil consumers.

Brent crude futures rose 87 cents, or 1.39%, to $63.60 a barrel by 0045 GMT after settling down 3.82% on Friday to the lowest since May 7.

US West Texas Intermediate crude was at $59.77 a barrel, up 87 cents, or 1.48%, following a 4.24% loss to reach its lowest since May 7.

Inter-bank market rates for dollar on Monday

BID Rs 281.16

OFFER Rs 281.36

Open-market movement

In the open market, the PKR gained 7 paise for buying and remained unchanged for selling against USD, closing at 281.63 and 282.20, respectively.

Against Euro, the PKR lost 68 paise for buying and 87 paise for selling, closing at 326.42 and 330.27, respectively.

Against UAE Dirham, the PKR gained 2 paise for buying and remained unchanged for selling, closing at 76.78 and 77.52, respectively.

Against Saudi Riyal, the PKR gained 1 paisa for buying and lost 2 paise for selling, closing at 75.03 and 75.65, respectively.

Open-market rates for dollar on Monday

BID Rs 281.63

OFFER Rs 282.20