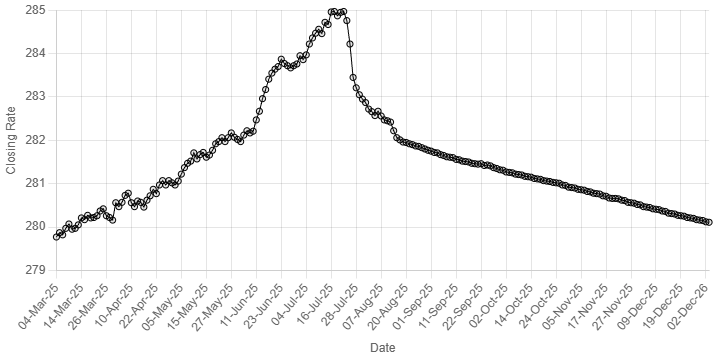

The Pakistani rupee reported marginal improvement against the US dollar in the inter-bank market on Monday.

At close, the local currency settled at 280.10, a gain of Re0.01 against the greenback.

During the previous week, the Pakistan rupee welcomed 2026 with another gain as it appreciated by Re0.06 or 0.02% against the US dollar in the inter-bank market.

The local unit closed at 280.11, against 280.17 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar started the first full trading week of the New Year on the front foot, rising to a 3-1/2-week peak versus the euro and a two-week high against the yen.

Currency traders largely looked past the United States’ weekend raid in Venezuela and the capture of President Nicolas Maduro, focusing instead on a slate of US macroeconomic indicators due this week that could be crucial in steering Federal Reserve policy.

The US dollar added 0.1% to $1.1704 per euro, and earlier strengthened as far as $1.170025 for the first time since December 11.

It climbed 0.2% to 157.08 yen after reaching 157.255 for the first time since December 22.

The data rollout this week begins with ISM manufacturing figures on Monday and culminates with the monthly non-farm payrolls report on Friday.

Traders currently expect two US rate cuts this year, according to LSEG calculations based on futures.

The dollar advanced 0.1% to $1.3443 per British pound, and gained 0.1% to C$1.3745.

The Aussie declined 0.2% to $0.6682.

Oil held broadly steady on Monday as traders shrugged off any possible impact on oil flows from the U.S. capture of President Nicolas Maduro of Venezuela, home of the biggest global oil reserves.

Brent crude futures were up 37 cents, or 0.6%, to $61.12 a barrel at 1244 GMT, while U.S. West Texas Intermediate crude ticked up 41 cents, or 0.7%, to $57.73 a barrel.

The benchmarks have crept in and out of negative territory in European trading as markets digested news that the U.S. had captured Venezuela’s leader and that Washington would take control of the OPEC member, whose crude exports had been under a U.S. embargo which is staying in place.

Inter-bank market rates for dollar on Monday

BID Rs 280.10

OFFER Rs 280.30

Open-market movement

In the open market, the PKR gained 4.00 paisa for buying and remained unchanged for selling against USD, closing at 280.50 and 281.15, respectively.

Against Euro, the PKR gained 1.52 rupee for buying and 1.37 rupee for selling, closing at 327.17 and 330.25, respectively.

Against UAE Dirham, the PKR gained 1.00 paisa for buying and 2.00 paisa for selling, closing at 76.50 and 77.25, respectively.

Against Saudi Riyal, the PKR remained unchanged for both buying and selling, closing at 74.80 and 75.42, respectively.

Open-market rates for dollar on Monday

BID Rs 280.50

OFFER Rs 281.15

American Dollar Exchange Rate

American Dollar Exchange Rate