The Pakistani rupee registered a marginal decline against the US dollar, depreciating 0.02% in the inter-bank market on Tuesday.

At close, the currency settled at 277.74, a loss of Re0.06 against the greenback.

On Monday, the rupee had settled at 277.68, according to the State Bank of Pakistan (SBP).

Globally, the US dollar eased a touch, though remained not too far from its recent high ahead of major US data releases later in the week that could determine the path for Federal Reserve policy.

The US dollar was headed for its best month in 2-1/2-years on Tuesday, as it eyed a 3.5% gain against a basket of currencies.

A raft of economic data underscoring the resilience of the US economy has bolstered the greenback over the past month, as has increasing market bets of a win by Republican candidate Donald Trump at next week’s US presidential election.

Ahead of that, a reading on September’s US core personal consumption expenditures price index – the Fed’s preferred measure of inflation – is due on Thursday followed by the closely watched nonfarm payrolls report on Friday.

The US dollar index was little changed at 104.28.

Oil prices, a key indicator of currency parity, were little changed on Tuesday after falling in the previous session as a US plan to buy oil for the Strategic Petroleum Reserve (SPR) provided some support though wider concerns about weaker future demand growth exerted pressure.

Brent crude futures climbed 4 cents to $71.46 a barrel by 0705 GMT, while US West Texas Intermediate crude was down 1 cent at $67.37 a barrel.

Both contracts tumbled 6% on Monday to their lowest since Oct. 1 after Israel’s retaliatory strike on Iran at the weekend bypassed Tehran’s oil infrastructure.

Inter-bank market rates for dollar on Tuesday

BID Rs 277.74

OFFER Rs 277.94

Open-market movement

In the open market, the PKR lost 10 paise for buying and 3 paise for selling against USD, closing at 276.81 and 278.66, respectively.

Against Euro, the PKR gained 1 paisa for buying and 2 paise for selling, closing at 297.84 and 300.55, respectively.

Against UAE Dirham, the PKR remained unchanged for buying and gained 1 paisa for selling, closing at 75.22 and 75.91, respectively.

Against Saudi Riyal, the PKR lost 6 paise for buying and 7 paise for selling, closing at 73.52 and 74.17, respectively.

Open-market rates for dollar on Tuesday

BID Rs 276.81

OFFER Rs 278.66

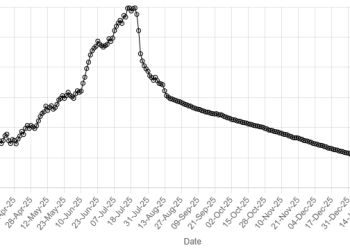

American Dollar Exchange Rate

American Dollar Exchange Rate