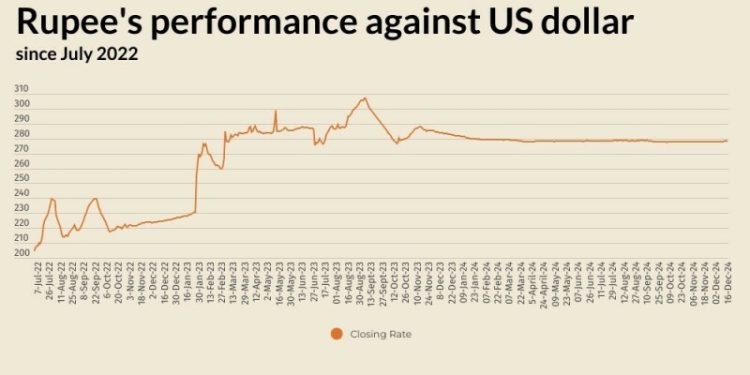

The Pakistani rupee saw a marginal decline against the US dollar, depreciating 0.02% in the inter-bank market on Monday.

At close, the currency settled at 278.17 for a loss of Re0.05 against the greenback.

During the previous week, the rupee decreased marginally against the US dollar as it lost Re0.11 or 0.04% in the inter-bank market.

The local unit closed at 278.12, against 278.01 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Globally, the US dollar hovered close to a three-week peak versus major peers on Monday amid expectations the Federal Reserve will cut interest rates this week but then signal a measured pace of easing for 2025.

Bitcoin soared above $105,000 for the first time, buoyed by signs President-elect Donald Trump will go ahead with a potential strategic bitcoin reserve.

The US dollar got additional support from climbing US Treasury yields. Traders are confident of a quarter-point Fed rate reduction on Wednesday but now expect officials to forgo a cut in January, according to CME’s FedWatch tool.

With inflation running above the central bank’s 2% annual target, Fed policymakers have stated that recent upticks are part of the bumpy path to lower price pressures and not a reversal of the disinflationary trend.

But analysts say they are also likely to be wary of renewed inflation with Trump set to take office in January.

The US dollar index – which tracks the currency against the euro, sterling, yen and three other top rivals – was steady at 106.86 as of 0053 GMT, after rising to 107.18 on Friday for the first time since November 26.

Oil prices, a key indicator of currency parity, eased from their highest levels in weeks as traders took profit while waiting for a Federal Reserve meeting later this week for clues on further rate cuts.

Falls were limited, however, by concerns of supply disruptions in the event of more US sanctions on major suppliers Russia and Iran.

Brent crude futures fell 29 cents, or 0.4%, to $74.20 a barrel by 0746 GMT after settling at their highest level since Nov. 22 on Friday.