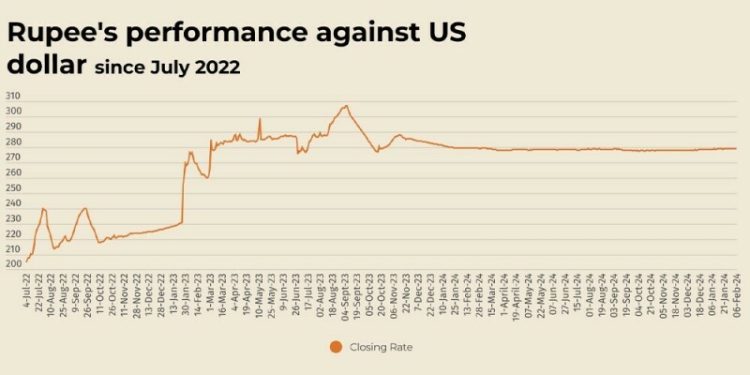

The Pakistani rupee recorded a marginal decline against the US dollar, depreciating 0.07% in the inter-bank market on Thursday.

At close, the currency settled at 279.15 for a loss of Re0.19 against the greenback, according to the State Bank of Pakistan (SBP).

The rupee had closed at 278.96 on Tuesday.

The currency market was closed on Wednesday for the Kashmir Day holiday.

Globally, the US dollar slumped to an eight-week trough to the yen and lingered near a one-month low versus sterling on Thursday, as investor nerves about an inflation-stoking global trade war abated.

Japan’s currency was also supported by rising expectations for further Bank of Japan interest-rate hikes with a central bank official advocating continued rate hikes, a day after strong wage data.

Sterling was firm even with the Bank of England widely expected to cut rates by a quarter point later in the day.

The US dollar sank 0.5% to 151.81 yen by 0140 GMT, the lowest since December 12, adding to a 1.1% slide on Wednesday.

Sterling was steady at $1.2509, after rising as high as $1.2550 in the previous session for the first time since January 7.

The dollar index – which measures the US currency against the euro, sterling, yen and three other major peers – stood at 107.57, not far from its overnight low of 107.29.

The index had jumped to a three-week high of 109.88 at the start of the week as Trump was poised to impose 25% import tariffs on Mexico and Canada, but the countries won last-minute, one-month reprieves – although Washington slapped 10% tariffs on China.

Oil prices, a key indicator of currency parity, edged up in Asian trading on Thursday after Saudi Arabia’s state oil company sharply raised March oil prices, but the increase was barely a blip on the biggest slide in benchmark Brent prices in nearly three months the previous day.

Brent crude futures rose 8 cents to $74.69 a barrel by 0422 GMT. US West Texas Intermediate crude was up 15 cents to $71.18 a barrel.

Oil prices had fallen more than 2% on Wednesday as a large build in US crude and gasoline stockpiles signalled weaker demand, and as investors weighed the implications of a new round of US-China trade tariffs, including duties on energy products.

Prices have plunged about 10% from the 2025 highs on January 15, five days before Donald Trump took over as US President.

American Dollar Exchange Rate

American Dollar Exchange Rate