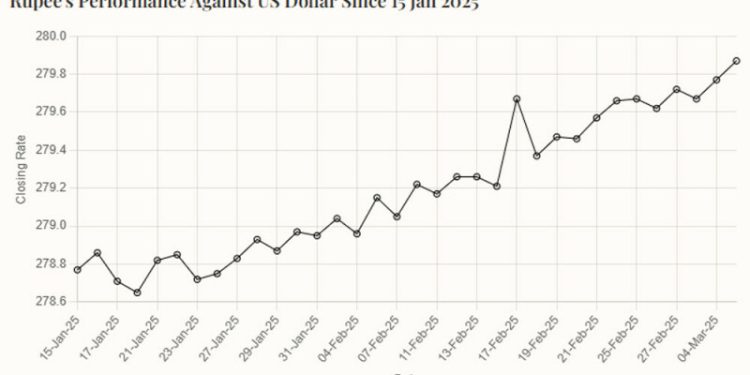

Rupee’s Performance Against US Dollar Since 15 Jan 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“15-Jan-25”, “16-Jan-25”, “17-Jan-25”, “20-Jan-25”, “21-Jan-25”, “22-Jan-25”, “23-Jan-25”,

“24-Jan-25”, “27-Jan-25”, “28-Jan-25”, “29-Jan-25”, “30-Jan-25”, “31-Jan-25”, “03-Feb-25”,

“04-Feb-25”, “06-Feb-25”, “07-Feb-25”, “10-Feb-25”, “11-Feb-25”, “12-Feb-25”, “13-Feb-25”,

“14-Feb-25”, “17-Feb-25”, “18-Feb-25”, “19-Feb-25”, “20-Feb-25”, “21-Feb-25”, “24-Feb-25”, “25-Feb-25”, “26-Feb-25”, “27-Feb-25”, “28-Feb-25”, “04-Mar-25”, “05-Mar-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

278.77, 278.86, 278.71, 278.65, 278.82, 278.85, 278.72, 278.75,

278.83, 278.93, 278.87, 278.97, 278.95, 279.04, 278.96, 279.15,

279.05, 279.22, 279.17, 279.26, 279.26, 279.21, 279.67, 279.37,

279.47, 279.46, 279.57, 279.66, 279.67, 279.62, 279.72, 279.67, 279.77, 279.87

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee recorded marginal decline against the US dollar, depreciating 0.05% in the inter-bank market on Wednesday.

At close, the rupee settled at 279.87, a loss of Re0.15 against the greenback.

On Tuesday, the rupee had closed at 279.72.

Internationally, the US dollar hovered near a three-month low versus major peers on Wednesday after the latest round of US tariffs and countermeasures from Canada and China stoked fears of an escalating trade war.

China’s yuan was firm in offshore trading following a rally of about 0.7% in the prior session, as annual parliamentary sessions of the National People’s Congress (NPC) kicked off with Beijing retaining a 5% economic growth goal for 2025.

The euro pushed to a near four-month peak as German political parties agreed to a 500-billion-euro infrastructure fund. Sterling also stood tall near a three-month high. Crude oil swooned to six-month lows, while bitcoin found its feet around $87,000 following a volatile week.

US President Donald Trump’s 25% tariffs on imports from Mexico and Canada, along with doubled duties of 20% on Chinese goods, took effect on Tuesday. China and Canada retaliated while Mexican President Claudia Sheinbaum vowed to respond likewise, without giving details.

The US dollar index, which measures the currency against the euro, sterling and four other major counterparts, was little changed at 105.60, after a two-day 1.9% slump that took it as low as 105.49 for the first time since December 6.

The euro rose as high as $1.0637 for the first time since November 13 in the latest session.

Oil prices, a key indicator of currency parity, fell for a third session on Wednesday as plans by major producers to raise output in April combined with concerns that US tariffs on Canada, Mexico and China will slow economic growth and hit fuel demand.

Brent futures fell 24 cents, or 0.3%, to $70.80 a barrel at 0500 GMT.

US West Texas Intermediate (WTI) crude slipped 58 cents, or 0.9%, to $67.68 a barrel.

In the previous session, the contracts settled at close to multi-month lows.

American Dollar Exchange Rate

American Dollar Exchange Rate