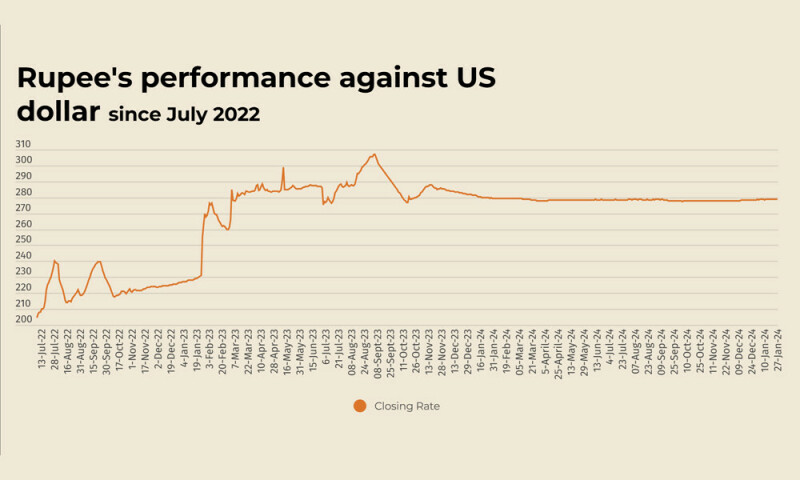

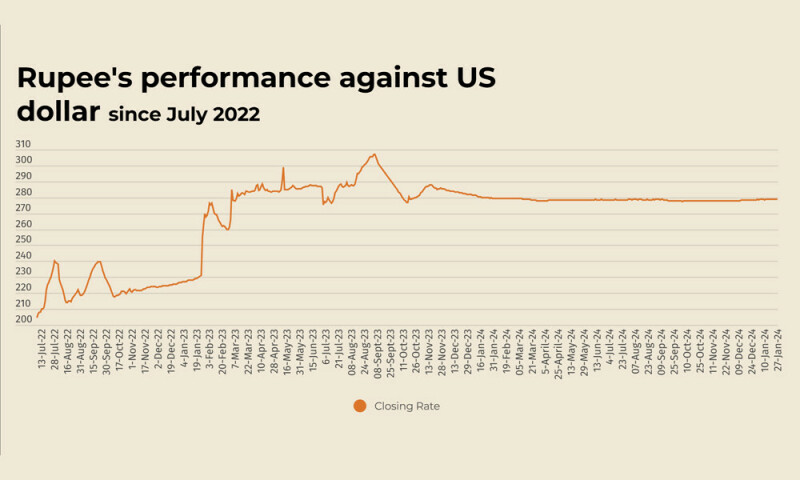

The Pakistani rupee saw a marginal decline against the US dollar, depreciating 0.03% in the inter-bank market on Monday.

At close, the currency settled at 278.83 for a loss of Re0.08 against the greenback.

Last week, the rupee remained largely stable against the US dollar in the inter-bank market during the previous week.

The local unit closed at 278.75, against 278.71 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar firmed on Monday as traders pondered the ramifications of US President Donald Trump’s tariff plans at the start of a week where the Federal Reserve is widely expected to hold interest rates steady.

The US dollar clocked its weakest week since November 2023 last week on ebbing fears of tariffs from the Trump administration, but those worries resurfaced after he said he will impose sweeping measures on Colombia.

The retaliatory moves, including tariffs and sanctions, comes after the South American country turned away two US military aircraft with migrants being deported as part of the new U.S. administration’s immigration crackdown.

That led to the Mexican peso, a barometer of tariff worries, sliding 0.8% to 20.426 per US dollar in early trade. The Canadian dollar was a bit weaker at $1.43715.

That left the US dollar index, which measures the U.S. currency against six units, at 107.6, still close to the one-month low it touched last week.

Investor focus this week will be on the central banks and how policymakers are likely to react after Trump said he wants the Federal Reserve to cut interest rates.

Oil prices, a key indicator of currency parity, slipped on Monday after US President Trump called on OPEC to reduce prices following the announcement of wide-ranging measures to boost US oil and gas output in his first week in office.

Brent crude futures dropped 35 cents, or 0.45%, to $78.15 a barrel by 0726 GMT after settling 21 cents higher on Friday.

US West Texas Intermediate crude was at $74.26 a barrel, down 40 cents, or 0.54%.

Inter-bank market rates for dollar on Monday

BID Rs 278.83

OFFER Rs 279.03

Open-market movement

In the open market, the PKR gained 40 paise for buying and 17 paise for selling against USD, closing at 278.82 and 281.04, respectively.

Against Euro, the PKR lost 35 paise for buying and 17 paise for selling, closing at 291.27 and 294.45, respectively.

Against UAE Dirham, the PKR gained 1 paisa for both buying and selling, closing at 75.95 and 76.56, respectively.

Against Saudi Riyal, the PKR gained 1 paisa for buying and remained unchanged for selling, closing at 74.23 and 74.80, respectively.

Open-market rates for dollar on Monday

BID Rs 278.82

OFFER Rs 281.04

The Pakistani rupee saw a marginal decline against the US dollar, depreciating 0.03% in the inter-bank market on Monday.

At close, the currency settled at 278.83 for a loss of Re0.08 against the greenback.

Last week, the rupee remained largely stable against the US dollar in the inter-bank market during the previous week.

The local unit closed at 278.75, against 278.71 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar firmed on Monday as traders pondered the ramifications of US President Donald Trump’s tariff plans at the start of a week where the Federal Reserve is widely expected to hold interest rates steady.

The US dollar clocked its weakest week since November 2023 last week on ebbing fears of tariffs from the Trump administration, but those worries resurfaced after he said he will impose sweeping measures on Colombia.

The retaliatory moves, including tariffs and sanctions, comes after the South American country turned away two US military aircraft with migrants being deported as part of the new U.S. administration’s immigration crackdown.

That led to the Mexican peso, a barometer of tariff worries, sliding 0.8% to 20.426 per US dollar in early trade. The Canadian dollar was a bit weaker at $1.43715.

That left the US dollar index, which measures the U.S. currency against six units, at 107.6, still close to the one-month low it touched last week.

Investor focus this week will be on the central banks and how policymakers are likely to react after Trump said he wants the Federal Reserve to cut interest rates.

Oil prices, a key indicator of currency parity, slipped on Monday after US President Trump called on OPEC to reduce prices following the announcement of wide-ranging measures to boost US oil and gas output in his first week in office.

Brent crude futures dropped 35 cents, or 0.45%, to $78.15 a barrel by 0726 GMT after settling 21 cents higher on Friday.

US West Texas Intermediate crude was at $74.26 a barrel, down 40 cents, or 0.54%.

Inter-bank market rates for dollar on Monday

BID Rs 278.83

OFFER Rs 279.03

Open-market movement

In the open market, the PKR gained 40 paise for buying and 17 paise for selling against USD, closing at 278.82 and 281.04, respectively.

Against Euro, the PKR lost 35 paise for buying and 17 paise for selling, closing at 291.27 and 294.45, respectively.

Against UAE Dirham, the PKR gained 1 paisa for both buying and selling, closing at 75.95 and 76.56, respectively.

Against Saudi Riyal, the PKR gained 1 paisa for buying and remained unchanged for selling, closing at 74.23 and 74.80, respectively.

Open-market rates for dollar on Monday

BID Rs 278.82

OFFER Rs 281.04