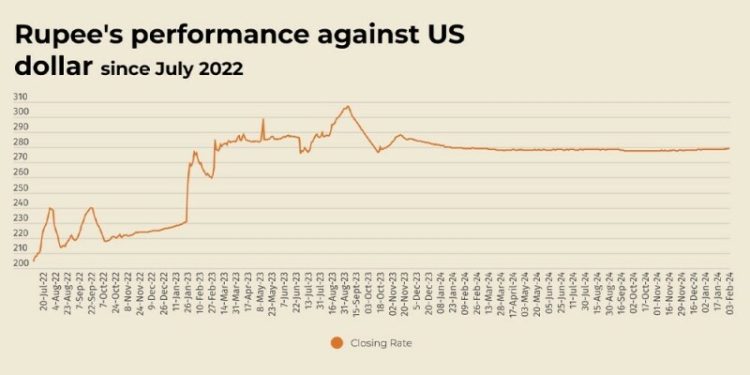

The Pakistani rupee registered a marginal decline against the US dollar, depreciating 0.03% in the inter-bank market on Monday.

At close, the currency settled at 279.04 for a loss of Re0.09 against the greenback, according to the State Bank of Pakistan (SBP).

During the previous week, the rupee depreciated against the US dollar as it lost Re0.20 or 0.07% in the inter-bank market.

The local unit closed at 278.95, against 278.75 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar surged on Monday, pushing its Canadian counterpart and Mexican peso to multi-year lows while China’s yuan slumped to a record low in offshore trading after US President Donald Trump kicked off a trade war by imposing sweeping tariffs.

The US dollar’s gains were broad, with the euro also dropping to a more than two-year low and the Swiss franc – despite typically acting as a safe haven – sliding to the weakest since May.

Canada and Mexico, top two US trading partners, immediately vowed retaliatory measures, and China said it would challenge Trump’s levies at the World Trade Organization.

Investors also pared back their expectations of rate cuts from the Federal Reserve, trimming about 6 basis points to 41 bps of easing this year in the wake of the tariff news.

The US dollar advanced 0.7% to 7.2552 yuan in the offshore market, having earlier pushed to a record high of 7.3765 yuan. Markets in China remain closed for the Lunar New year and will resume trading on Wednesday.

Oil prices, a key indicator of currency parity, jumped on Monday after Trump imposed tariffs on Canada, Mexico and China, raising fears of crude supply disruption from the two biggest suppliers to the US, but the prospect of lower fuel demand capped gains.

US West Texas Intermediate crude futures were at $73.89 a barrel, up $1.36, or 1.88%, by 0656 GMT, after hitting its highest since Jan. 24 at $75.18 a barrel earlier in the session.

Brent crude futures rose 73 cents, or 0.96%, to $76.40 a barrel, after touching a high of $77.34.

Inter-bank market rates for dollar on Monday

BID Rs 279.04

OFFER Rs 279.24

Open-market movement

In the open market, the PKR gained 1 paisa for buying and lost 5 paise for selling against USD, closing at 278.75 and 280.88, respectively.

Against Euro, the PKR gained 3.94 rupees for buying and 3.55 rupees for selling, closing at 285.46 and 288.61, respectively.

Against UAE Dirham, the PKR lost 2 paise for buying and remained unchanged for selling, closing at 76.00 and 76.50, respectively.

Against Saudi Riyal, the PKR lost 1 paisa for buying and remained unchanged for selling, closing at 74.26 and 74.75, respectively.

Open-market rates for dollar on Monday

BID Rs 278.75

OFFER Rs 280.88

The Pakistani rupee registered a marginal decline against the US dollar, depreciating 0.03% in the inter-bank market on Monday.

At close, the currency settled at 279.04 for a loss of Re0.09 against the greenback, according to the State Bank of Pakistan (SBP).

During the previous week, the rupee depreciated against the US dollar as it lost Re0.20 or 0.07% in the inter-bank market.

The local unit closed at 278.95, against 278.75 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar surged on Monday, pushing its Canadian counterpart and Mexican peso to multi-year lows while China’s yuan slumped to a record low in offshore trading after US President Donald Trump kicked off a trade war by imposing sweeping tariffs.

The US dollar’s gains were broad, with the euro also dropping to a more than two-year low and the Swiss franc – despite typically acting as a safe haven – sliding to the weakest since May.

Canada and Mexico, top two US trading partners, immediately vowed retaliatory measures, and China said it would challenge Trump’s levies at the World Trade Organization.

Investors also pared back their expectations of rate cuts from the Federal Reserve, trimming about 6 basis points to 41 bps of easing this year in the wake of the tariff news.

The US dollar advanced 0.7% to 7.2552 yuan in the offshore market, having earlier pushed to a record high of 7.3765 yuan. Markets in China remain closed for the Lunar New year and will resume trading on Wednesday.

Oil prices, a key indicator of currency parity, jumped on Monday after Trump imposed tariffs on Canada, Mexico and China, raising fears of crude supply disruption from the two biggest suppliers to the US, but the prospect of lower fuel demand capped gains.

US West Texas Intermediate crude futures were at $73.89 a barrel, up $1.36, or 1.88%, by 0656 GMT, after hitting its highest since Jan. 24 at $75.18 a barrel earlier in the session.

Brent crude futures rose 73 cents, or 0.96%, to $76.40 a barrel, after touching a high of $77.34.

Inter-bank market rates for dollar on Monday

BID Rs 279.04

OFFER Rs 279.24

Open-market movement

In the open market, the PKR gained 1 paisa for buying and lost 5 paise for selling against USD, closing at 278.75 and 280.88, respectively.

Against Euro, the PKR gained 3.94 rupees for buying and 3.55 rupees for selling, closing at 285.46 and 288.61, respectively.

Against UAE Dirham, the PKR lost 2 paise for buying and remained unchanged for selling, closing at 76.00 and 76.50, respectively.

Against Saudi Riyal, the PKR lost 1 paisa for buying and remained unchanged for selling, closing at 74.26 and 74.75, respectively.

Open-market rates for dollar on Monday

BID Rs 278.75

OFFER Rs 280.88