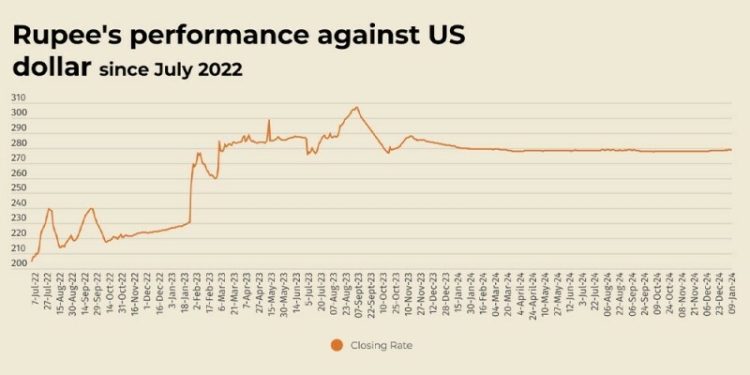

The Pakistani rupee recorded a marginal improvement against the US dollar, appreciating 0.04% in the inter-bank market on Thursday.

At close, the currency settled at 278.61 for a gain of Re0.11 against the greenback.

The rupee settled at 278.72 on Wednesday, according to the State Bank of Pakistan (SBP).

Globally, the US dollar charged ahead on Thursday underpinned by rising Treasury yields, putting the yen, sterling and euro under pressure near multi-month lows amid the shifting threat of tariffs.

The focus for markets in 2025 has been on US President-elect Donald Trump’s policies as he steps back into the White House on Jan. 20, with analysts expecting his policies to both bolster growth and add to price pressures.

CNN on Wednesday reported that Trump is considering declaring a national economic emergency to provide legal justification for a series of universal tariffs on allies and adversaries.

On Monday, the Washington Post said Trump was looking at more nuanced tariffs, which he later denied.

That left the dollar index, which measures the US currency against six other units, at 109.03, just shy of the two-year high it touched last week. The index gained 7% last year as traders adjusted expectations of a measured pace of US rate cuts.

The Federal Reserve last month jolted markets by projecting two rate cuts for 2025, down from four it had previously predicted, due to concerns about inflation as well as Trump administration policies.

Oil prices, a key indicator of currency parity, were little changed on Thursday as investors weighed firm winter fuel demand expectations against large US fuel inventories and macroeconomic concerns.

Brent crude futures were down 3 cents at $76.13 a barrel by 1003 GMT.

US West Texas Intermediate crude futures dipped 10 cents to $73.22.

Both benchmarks fell more than 1% on Wednesday as a stronger dollar and a bigger-than-expected rise in US fuel stockpiles pressured prices.

Inter-bank market rates for dollar on Thursday

BID Rs 278.61

OFFER Rs 278.81

Open-market movement

In the open market, the PKR lost 13 paise for buying and gained 6 paise

for selling against USD, closing at 278.59 and 280.18, respectively.

Against Euro, the PKR gained 76 paise for buying and 91 paise for

selling, closing at 286.51 and 289.20, respectively.

Against UAE Dirham, the PKR gained 1 paisa for buying and 5 paise for

selling, closing at 75.76 and 76.25, respectively.

Against Saudi Riyal, the PKR lost 2 paise for buying and gained 5 paise for selling, closing at 74.08 and 74.50, respectively.

Open-market rates for dollar on Thursday

BID Rs 278.59

OFFER Rs 280.18