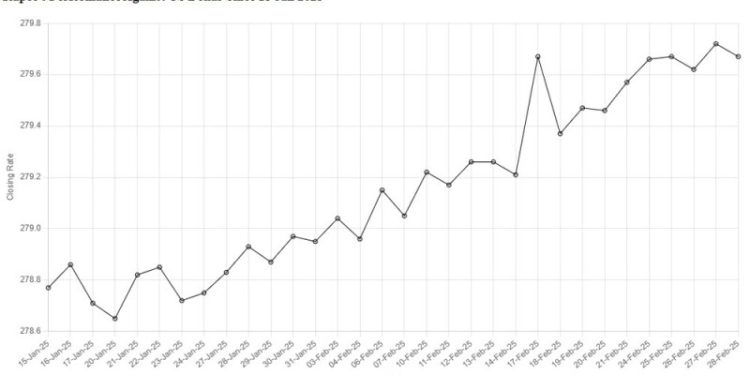

Rupee’s Performance Against US Dollar Since 15 Jan 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“15-Jan-25”, “16-Jan-25”, “17-Jan-25”, “20-Jan-25”, “21-Jan-25”, “22-Jan-25”, “23-Jan-25”,

“24-Jan-25”, “27-Jan-25”, “28-Jan-25”, “29-Jan-25”, “30-Jan-25”, “31-Jan-25”, “03-Feb-25”,

“04-Feb-25”, “06-Feb-25”, “07-Feb-25”, “10-Feb-25”, “11-Feb-25”, “12-Feb-25”, “13-Feb-25”,

“14-Feb-25”, “17-Feb-25”, “18-Feb-25”, “19-Feb-25”, “20-Feb-25”, “21-Feb-25”, “24-Feb-25”, “25-Feb-25”, “26-Feb-25”, “27-Feb-25”, “28-Feb-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

278.77, 278.86, 278.71, 278.65, 278.82, 278.85, 278.72, 278.75,

278.83, 278.93, 278.87, 278.97, 278.95, 279.04, 278.96, 279.15,

279.05, 279.22, 279.17, 279.26, 279.26, 279.21, 279.67, 279.37,

279.47, 279.46, 279.57, 279.66, 279.67, 279.62, 279.72, 279.67

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee recorded marginal improvement against the US dollar, appreciating 0.02% in the inter-bank market on Friday.

At close, the rupee settled at 279.67, a gain of Re0.05 against the greenback.

On Thursday, the rupee had closed at 279.72.

Globally, the US dollar drew safe-haven support on Friday ahead of US President Donald Trump’s impending tariffs, though was still headed for a monthly loss as investors weighed those threats against a darkening US growth outlook.

The US dollar index last stood at 107.24, having jumped nearly 0.9% on Thursday. Still, the index was on track for a monthly loss of 1.1%, its worst since August, as the US dollar continues to face some downward pressure amid worries over the health of the world’s largest economy.

A raft of weaker-than-expected economic data has led to traders ramping up bets of more Federal Reserve rate cuts this year, which has in turn sent US Treasury yields lower and been a drag on the US dollar.

Oil prices, a key indicator of currency parity, eased on Friday as they headed for their first monthly drop since November, dragged lower by uncertainty over global economic growth and fuel demand given Washington’s tariff threats and signs of a US economic slowdown.

The more active May Brent crude futures slipped 59 cents, or 0.8%, to $72.98 a barrel by 0747 GMT. US West Texas Intermediate crude futures were at $69.70 a barrel, down 65 cents, or 0.9%.

Front-month Brent, which expires on Friday, traded at $73.42, down 62 cents, or 0.8%.

Both benchmarks are on track to post their first monthly decline in three months.

American Dollar Exchange Rate

American Dollar Exchange Rate