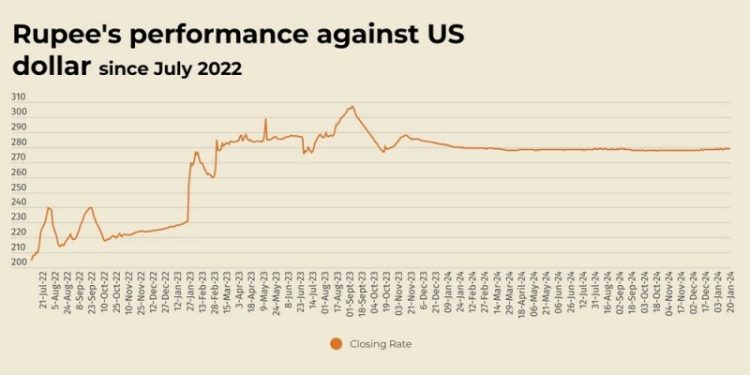

The Pakistani rupee saw marginal improvement against the US dollar, appreciating 0.02% in the inter-bank market on Monday.

At close, the currency settled at 278.65 for a gain of Re0.06 against the greenback.

During the previous week, the rupee recorded a marginal decline against the US dollar as it depreciated Re0.13 or 0.05% in the inter-bank market. The local unit closed at 278.71, against 278.58 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar was hovering near a more than two-year high at the start of a pivotal week on Monday, as Donald Trump re-enters the White House with an inauguration speech that will be of primary focus for investors hoping to decipher his immediate policies.

Investors are also keeping an eye on Middle East developments after Hamas released three Israeli hostages and Israel released 90 Palestinian prisoners on Sunday, the first day of a ceasefire suspending a 15-month-old war.

Cryptocurrency investors remain in party mode awaiting executive orders from Trump aimed at reducing regulatory roadblocks and promoting the widespread adoption of digital assets.

Trump courted crypto campaign cash promising to be a “crypto president” and launched a digital token on Friday, which soared above $70 at one point for a market value north of $15 billion. It was last trading around $42, CoinMarketCap.

The spotlight is firmly on the policies Trump will enact on his first day in office. At a rally a day before, Trump said he would impose severe limits on immigration.

The US dollar index, which measures the US currency against six peers, was at 109.28 in early trade, near the 26-month high of 110.17 touched last week.

Oil prices, a key indicator of currency parity, were little changed on Monday as expectations of US President-elect Donald Trump relaxing curbs on Russia’s energy sector in exchange for a deal to end the Ukraine war offset concerns of supply disruption from harsher sanctions.

Brent crude futures dropped 6 cents, or 0.07%, to $80.73 a barrel by 0229 GMT after closing down 0.62% in the previous session.

US West Texas Intermediate crude, which expires on Tuesday, was at $77.98 a barrel, up 10 cents, or 0.13%, after settling down 1.02% on Friday.

The more active April contract fell 1 cent to $77.38 a barrel.

Inter-bank market rates for dollar on Monday

BID Rs 278.65

OFFER Rs 278.85

Open-market movement

In the open market, the PKR lost 5 paise for buying and 18 paise for selling against USD, closing at 279.37 and 281.17, respectively.

Against Euro, the PKR lost 3 paise for buying and 9 paise for selling,

closing at 287.20 and 289.95, respectively.

Against UAE Dirham, the PKR lost 2 paise for buying and 4 paise for

selling, closing at 75.98 and 76.55, respectively.

Against Saudi Riyal, the PKR lost 1 paisa for buying and 5.00 paisa for selling, closing at 74.25 and 74.80, respectively.

Open-market rates for dollar on Monday

BID Rs 279.37

OFFER Rs 281.17

The Pakistani rupee saw marginal improvement against the US dollar, appreciating 0.02% in the inter-bank market on Monday.

At close, the currency settled at 278.65 for a gain of Re0.06 against the greenback.

During the previous week, the rupee recorded a marginal decline against the US dollar as it depreciated Re0.13 or 0.05% in the inter-bank market. The local unit closed at 278.71, against 278.58 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar was hovering near a more than two-year high at the start of a pivotal week on Monday, as Donald Trump re-enters the White House with an inauguration speech that will be of primary focus for investors hoping to decipher his immediate policies.

Investors are also keeping an eye on Middle East developments after Hamas released three Israeli hostages and Israel released 90 Palestinian prisoners on Sunday, the first day of a ceasefire suspending a 15-month-old war.

Cryptocurrency investors remain in party mode awaiting executive orders from Trump aimed at reducing regulatory roadblocks and promoting the widespread adoption of digital assets.

Trump courted crypto campaign cash promising to be a “crypto president” and launched a digital token on Friday, which soared above $70 at one point for a market value north of $15 billion. It was last trading around $42, CoinMarketCap.

The spotlight is firmly on the policies Trump will enact on his first day in office. At a rally a day before, Trump said he would impose severe limits on immigration.

The US dollar index, which measures the US currency against six peers, was at 109.28 in early trade, near the 26-month high of 110.17 touched last week.

Oil prices, a key indicator of currency parity, were little changed on Monday as expectations of US President-elect Donald Trump relaxing curbs on Russia’s energy sector in exchange for a deal to end the Ukraine war offset concerns of supply disruption from harsher sanctions.

Brent crude futures dropped 6 cents, or 0.07%, to $80.73 a barrel by 0229 GMT after closing down 0.62% in the previous session.

US West Texas Intermediate crude, which expires on Tuesday, was at $77.98 a barrel, up 10 cents, or 0.13%, after settling down 1.02% on Friday.

The more active April contract fell 1 cent to $77.38 a barrel.

Inter-bank market rates for dollar on Monday

BID Rs 278.65

OFFER Rs 278.85

Open-market movement

In the open market, the PKR lost 5 paise for buying and 18 paise for selling against USD, closing at 279.37 and 281.17, respectively.

Against Euro, the PKR lost 3 paise for buying and 9 paise for selling,

closing at 287.20 and 289.95, respectively.

Against UAE Dirham, the PKR lost 2 paise for buying and 4 paise for

selling, closing at 75.98 and 76.55, respectively.

Against Saudi Riyal, the PKR lost 1 paisa for buying and 5.00 paisa for selling, closing at 74.25 and 74.80, respectively.

Open-market rates for dollar on Monday

BID Rs 279.37

OFFER Rs 281.17