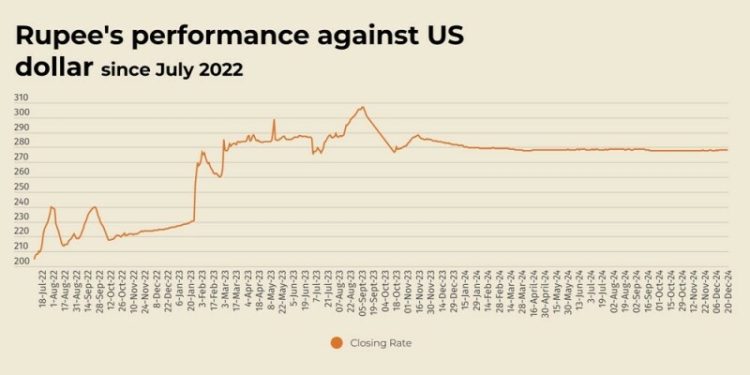

The Pakistani rupee reported a slight decline against the US dollar, depreciating 0.03% in the inter-bank market on Friday.

At close, the currency settled at 278.42 for a loss of Re0.07 against the greenback.

On Thursday, the rupee had settled at 278.35, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar was set to cap the week on a strong note on Friday as it was perched near a two-year high bolstered by a hawkish US rate outlook, while the yen struggled to stay afloat as it again weakened to a new low.

Currencies took a breather after huge moves in the previous session sparked by a broad rally in the greenback.

The greenback stayed on the front foot and attempted to notch a fresh two-year peak against a basket of currencies, with the US dollar index last up 0.02% at 108.45.

It was set to end the week with a 1.4% gain, underpinned by expectations that US rates will stay higher for longer. Markets are now pricing in less than 40 bps worth of cuts for 2025.

Focus is now on the release of the core PCE price data – the Fed’s preferred measure of inflation – later on Friday, for further clues on the outlook for the US economy.

Oil prices, a key indicator of currency parity, fell on Friday on worries about demand growth in 2025, especially in top crude importer China, putting global oil benchmarks on track to end the week down nearly 3%.

Brent crude futures fell by 41 cents, or 0.56%, to $72.47 a barrel by 0420 GMT. US West Texas Intermediate crude futures fell 39 cents, or 0.56%, to $68.99 per barrel.

American Dollar Exchange Rate

American Dollar Exchange Rate