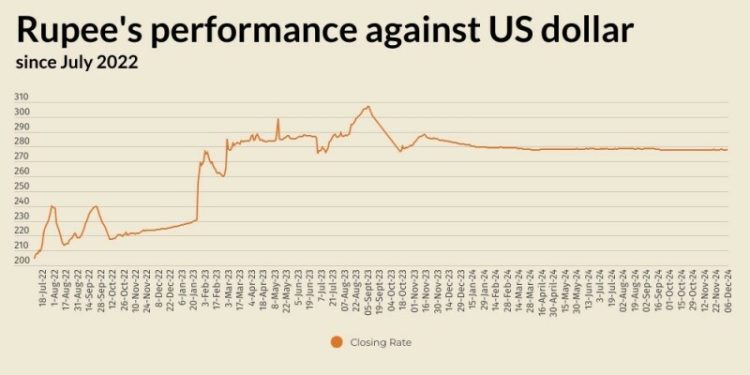

The Pakistani rupee recorded a marginal decline against the US dollar, depreciating 0.03% in the inter-bank market on Friday.

At close, the currency settled at 278.01, a loss of Re0.07 against the greenback.

On Thursday, the rupee had settled at 277.94, according to the State Bank of Pakistan (SBP).

Internationally, major currencies remained jittery on Friday as markets considered the impact of a politically turbulent week that saw the collapse of France’s government and the brief imposition of martial law in South Korea.

The US dollar spiked against South Korea’s won after local media reported that South Korea’s main opposition Democratic Party said lawmakers were on standby after receiving reports of another martial law declaration.

In cryptocurrencies, bitcoin took a breather after catapulting above $100,000 for the first time a day earlier, and even sceptics now expect a crypto-friendly Trump administration to feed an extended rally.

On the broader economic front, the spotlight will be on the US non-farm payrolls report for November due later in the day as investors look to second guess the pace of future Federal Reserve rate cuts.

Markets currently see about a 72% chance that the Federal Reserve will deliver a 25-basis-point rate cut when it meets on Dec. 17-18, up from 66.5% a week ago, CME FedWatch tool showed.

Oil prices, a key indicator of currency parity, fell on Friday as analysts continued to forecast a supply surplus in 2025 despite the OPEC+ decision to postpone planned supply increases and extend deep output cuts to the end of 2026.

Brent crude futures were down 66 cents, or 0.9%, to $71.43 per barrel at 1128 GMT. U.S. West Texas Intermediate crude futures were down 65 cents, or 1%, to $67.65 per barrel.

For the week, Brent was on track to fall 2%, while WTI was on course for a 0.5% drop.