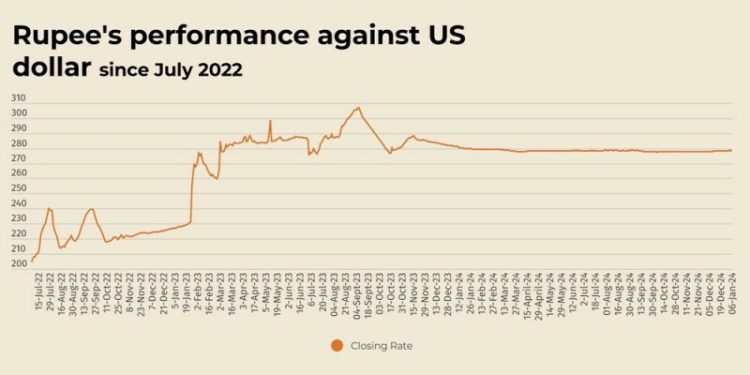

The Pakistani rupee registered a marginal decline against the US dollar, depreciating 0.02% in the inter-bank market on Monday.

At close, the currency settled at 278.62 for a loss of Re0.06 against the greenback.

During the previous week, the rupee decreased marginally against the US dollar as it lost Re0.09 or 0.3% in the inter-bank market.

The local unit closed at 278.56, against 278.47 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Globally, the US dollar eased a touch on Monday but stayed close to a two-year peak, as traders awaited a raft of US economic data releases this week headlined by December’s nonfarm payrolls report, for further clues on the Federal Reserve’s rate outlook.

Also in focus was the Chinese yuan, which on Friday weakened past the psychological level of 7.3 per dollar in the onshore market for the first time in 14 months, after the People’s Bank of China (PBOC) had aggressively defended that key threshold for most of December.

The onshore yuan was last 0.05% lower at 7.3252 per US dollar, while its offshore counterpart ticked up 0.15% to 7.3487 per US dollar.

In the broader market, investors had their eye on Friday’s closely watched US jobs report for further clarity on the health of the world’s largest economy.

A slew of Fed policymakers are also due to speak this week, where they are likely to reiterate recent comments from their colleagues that the fight against taming inflation is not yet done.

The US dollar has continued to draw strength from expectations of fewer Fed cuts this year, with its climb to a two-year high last week pushing the euro to its weakest level in more than two years.

Oil prices, a key indicator of currency parity, eased on Monday, pressured by a strong dollar, but remained at their highest since mid-October as colder weather spurred buying while further support came from expectations of tighter sanctions on Iranian and Russian oil exports.

Brent crude futures lost 33 cents, or 0.4%, to $76.18 a barrel by 0950 GMT, their highest since Oct. 14.

US West Texas Intermediate crude was down 35 cents, or 0.5%, at $73.61, also the highest level since Oct. 14.

Inter-bank market rates for dollar on Monday

BID Rs 278.62

OFFER Rs 278.82

Open-market movement

In the open market, the PKR lost 12 paise for buying and 15 paise for selling against USD, closing at 278.19 and 280.00, respectively.

Against Euro, the PKR lost 1.48 rupee for buying and 94 paise for selling, closing at 287.20 and 289.24, respectively.

Against UAE Dirham, the PKR lost 1 paisa for buying and 5 paise for selling, closing at 75.67 and 76.20, respectively.

Against Saudi Riyal, the PKR gained 1 paisa for buying and remained unchanged for selling, closing at 73.97 and 74.45, respectively.

Open-market rates for dollar on Monday

BID Rs 278.19

OFFER Rs 280.00

American Dollar Exchange Rate

American Dollar Exchange Rate