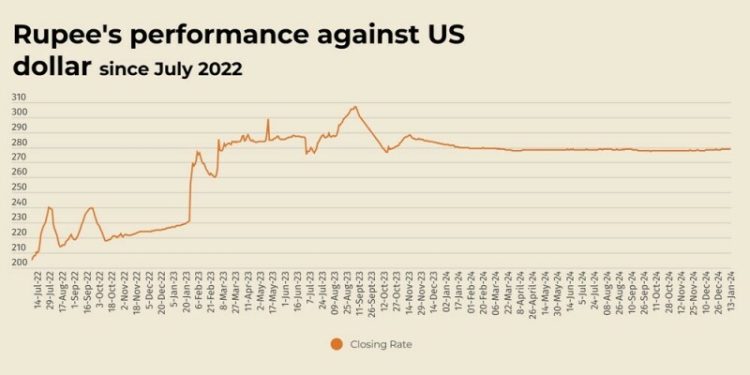

The Pakistani rupee saw a marginal decline against the US dollar, depreciating 0.04% in the inter-bank market on Monday.

At close, the currency settled at 278.68 after a loss of Re0.10 against the greenback.

During the previous week, rupee remained largely stable against the US dollar in the inter-bank market.

The local unit closed at 278.58, against 278.56 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar began the week on a strong note on Monday, leaving its peers languishing near multi-year lows after a blowout US jobs report that underlined the outperformance of the world’s largest economy versus the rest of the world.

Markets are now pricing in just 27 basis points worth of Fed rate cuts this year, down from roughly 50 bps at the start of the year.

Adding to expectations of a less aggressive easing cycle is the view that U.S. President-elect Donald Trump’s plans for hefty import tariffs, tax cuts and immigration restrictions could stoke inflation. He returns to the White House in a week.

Ahead of that, data on US inflation is due on Wednesday, where any upside surprise could threaten to close the door on easing altogether. A slew of Fed officials are also due to speak this week.

The US dollar was firm at 109.67 against a basket of currencies , hovering near its strongest since November 2022.

Oil prices, a key indicator of currency parity, extended gains for a third session on Monday, with Brent rising above $80 a barrel to its highest in more than four months, as wider US sanctions are expected to affect Russian crude exports to top buyers China and India.

Brent crude futures climbed $1.14, or 1.43%, to $80.90 a barrel by 0741 GMT after hitting an intraday high of $81.49, the highest since Aug. 27.

US West Texas Intermediate crude rose $1.20, or 1.57% to $77.77 a barrel after touching a high of $78.39, the most since Oct. 8.

Brent and WTI have risen by more than 6% since Jan. 8, and both contracts surged after the US Treasury imposed wider sanctions on Russian oil on Friday.

Inter-bank market rates for dollar on Monday

BID Rs 278.68

OFFER Rs 278.88

Open-market movement

In the open market, the PKR lost 19 paise for buying and 30 paise for selling against USD, closing at 278.78 and 280.48, respectively.

Against Euro, the PKR gained 2.18 rupees for buying and 1.94 rupee for selling, closing at 284.28 and 287.23, respectively.

Against UAE Dirham, the PKR lost 8 paise for buying and 6 paise for selling, closing at 75.87 and 76.36, respectively.

Against Saudi Riyal, the PKR lost 8 paise for buying and 7 paise for selling, closing at 74.16 and 74.62, respectively.

Open-market rates for dollar on Monday

BID Rs 278.78

OFFER Rs 280.48