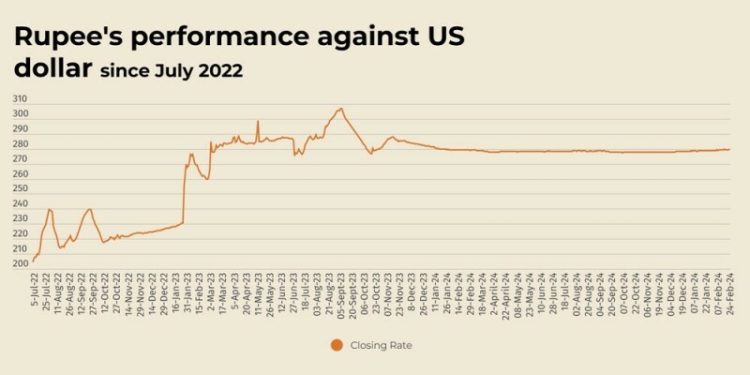

The Pakistani rupee recorded a marginal decline against the US dollar, depreciating 0.03% in the inter-bank market on Monday.

At close, the rupee settled at 279.66, a loss of Re0.09 against the greenback.

During the previous week, rupee depreciated against the US dollar as it lost Re0.36 or 0.13% in the inter-bank market.

The local unit closed at 279.57, against 279.21 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

An International Monetary Fund (IMF) mission would arrive in Islamabad in early to mid-March for discussions on the first review under Pakistan’s Extended Fund Facility (EFF) programme.

Internationally, the US dollar was pinned at 149.36 yen, having shed 2% last week to threaten chart support at 148.65.

The US dollar index dipped 0.3% to 106.210, with losses on the euro, sterling and Swiss franc.

US business activity nearly stalled in February amid mounting fears over tariffs on imports and cuts in federal spending, data released on Friday showed. Separately, data revealed that US consumer sentiment dropped more than expected to a 15-month low and inflation expectations rocketed.

Oil prices, a key indicator of currency parity, slipped in Asia on Monday, extending losses from last week, on the prospect of a resumption of exports from Kurdistan’s oilfields, while investors awaited clarity on talks to resolve Russia’s war on Ukraine.

Brent futures were down 1 cent, or 0.01%, at $74.42 barrel, as of 0731 GMT, while US West Texas Intermediate crude futures lost 12 cents, or 0.2%, to $70.28 a barrel.

Both Brent and WTI dropped by more than $2 on Friday, posting weekly declines of 0.4% and 0.5%, respectively.

Inter-bank market rates for dollar on Monday

BID Rs 279.66

OFFER Rs 279.86

Open-market movement

In the open market, the PKR lost 11 paise for buying and 3 paise for selling against USD, closing at 279.02 and 281.20, respectively.

Against Euro, the PKR lost 35 paise for buying and 44 paise for selling, closing at 292.43 and 295.53, respectively.

Against UAE Dirham, the PKR lost 1 paisa for buying and remained unchanged for selling, closing at 76.03 and 76.59, respectively.

Against Saudi Riyal, the PKR lost 2 paise for buying and 1 paisa for selling, closing at 74.30 and 74.85, respectively.

Open-market rates for dollar on Monday

BID Rs 279.02

OFFER Rs 281.20