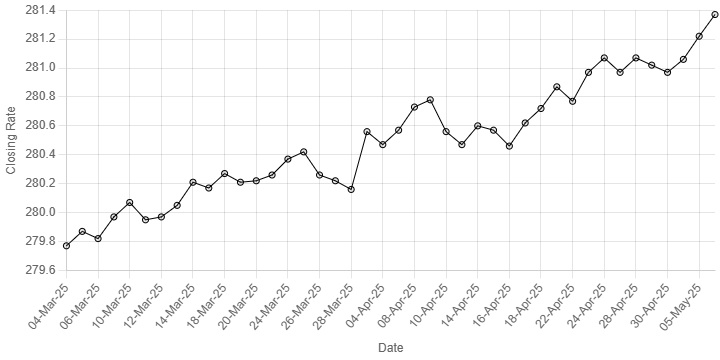

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee posted a marginal decline against the US dollar, depreciating 0.05% in the inter-bank market on Tuesday.

At close, the local currency settled at 281.37, a loss of Re0.15 against the greenback.

On Monday, the rupee closed the day at 281.22.

Internationally, the US dollar struggled to make headway on Tuesday as an unprecedented two-day surge in its Taiwanese counterpart spilled over to other regional peers and highlighted the fragility of the US currency.

Hong Kong’s de-facto central bank said earlier in the day it bought $7.8 billion (HK$60.5 billion) to stop the local currency from strengthening and breaking its peg to the US dollar.

Investors were also awaiting actual progress in trade negotiations with the United States and evidence of a thaw in Sino-US relations, as opposed to just hints from officials.

The Taiwan dollar on Monday surged to a three-year high of 29.59 per dollar, having leapt 8% in two days, in a move which coincided with the end of US-Taiwan trade talks in Washington. It was last steady at 30.02 per US dollar.

Against a basket of currencies, the dollar was up 0.2% at 100.04. The dollar index had clocked a monthly decline of 4.3% last month, the largest in over two years.

The Federal Reserve announces its policy decision on Wednesday and is expected to keep rates on hold, but the meeting may be the last where the outcome is so cut and dry.

Oil, a key indicator of currency parity, steadied on Tuesday after hitting four-year lows in the previous session that was driven by an OPEC+ decision to accelerate output increases, stoking fears of oversupply at a time when US tariffs have spurred concerns about demand.

Brent crude futures rose 10 cents to $60.33 a barrel by 0050 GMT, while US West Texas Intermediate crude added 10 cents to $57.23 a barrel.

Both benchmarks had settled at their lowest since February 2021 on Monday.

Inter-bank market rates for dollar on Tuesday

BID Rs 281.37

OFFER Rs 281.57

Open-market movement

In the open market, the PKR lost 28 paise for buying and 22 paise for selling against USD, closing at 281.74 and 283.12, respectively.

Against Euro, the PKR gained 6 paise for buying and 4 paise for selling, closing at 318.56 and 321.62, respectively.

Against UAE Dirham, the PKR lost 6 paise for both buying and selling, closing at 76.58 and 77.19, respectively.

Against Saudi Riyal, the PKR lost 6 paise for buying and 3 paise for selling, closing at 75.16 and 75.73, respectively.

Open-market rates for dollar on Tuesday

BID Rs 281.74

OFFER Rs 283.12