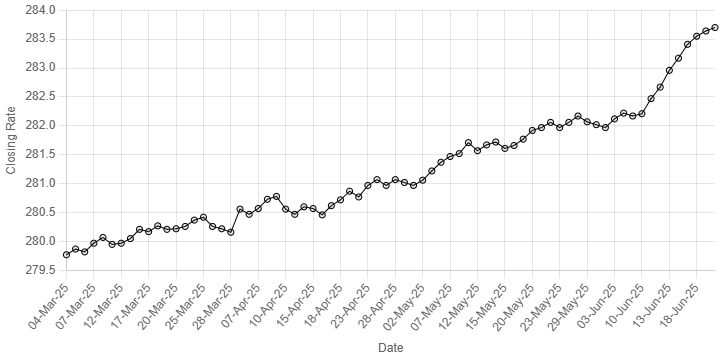

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”, “13-Jun-25”, “16-Jun-25”, “17-Jun-25”, “18-Jun-25”, “19-Jun-25”, “20-Jun-25”,

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67, 282.96, 283.17, 283.41, 283.55, 283.64, 283.70

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee posted marginal decline against the US dollar, depreciating 0.02% during trading in the interbank market on Friday.

At close, the local currency settled at 283.70, a loss of Re0.06 against the greenback.

On Thursday, the local unit closed at 283.64.

Internationally, the US dollar was set to log its biggest weekly rise in over a month on Friday, as uncertainties about a raging war in the Middle East and the repercussions it could have on the global economy fuelled an appetite for traditional safe havens.

The dollar index, comparing the US currency against six others, is poised for a 0.5% climb this week. The conflict between Israel and Iran shows no signs of subsiding, and market participants are nervous about potential US intervention in the region.

The two countries have been in a week-long air battle as Tel Aviv seeks to thwart Tehran’s nuclear ambitions and cripple the domestic government. The White House said US President Donald Trump will decide within the next two weeks about whether to join Israel in the war.

The recent spike in oil prices has added a new layer of inflation uncertainty for central banks across regions, which have been grappling with the potential repercussions of US tariffs on their economies.

In early Asia trading, the euro inched up 0.16% to $1.151, while the dollar weakened against the yen by 0.17% to 145.23 per dollar.

Also underpinning the yen’s gains was hotter-than-expected inflation data that kept expectations for upcoming interest rate hikes alive. Furthermore, minutes from the Bank of Japan’s policy meeting this week showed policymakers agreed on the need to keep raising rates that are still at very low levels.

Oil prices, a key indicator of currency parity, pared gains from the previous session and fell nearly $2 on Friday after the White House delayed a decision on US involvement in the Israel-Iran conflict, but they were still poised for a third straight week in the black.

Brent crude futures fell $1.89, or 2.4%, to $76.96 a barrel by 0255 GMT. On a weekly basis, it was up 3.8%.

The US West Texas Intermediate crude for July – which did not settle on Thursday as it was a US holiday and expires on Friday – was up 53 cents, or 0.7%, to $75.67. The more liquid WTI for August rose 0.2%, or 17 cents, to $73.67.

Prices jumped almost 3% on Thursday as Israel bombed nuclear targets in Iran, and Iran fired missiles and drones at Israel after hitting an Israeli hospital overnight. The week-old war between Israel and Iran showed no signs of either side backing down.

Inter-bank market rates for dollar on Friday

BID Rs 283.70

OFFER Rs 283.90

Open-market movement

In the open market, the PKR lost 10 paise for buying and 5 paise for selling against USD, closing at 284.23 and 285.74, respectively.

Against Euro, the PKR lost 1.93 rupee for buying and 2.00 rupees for selling, closing at 326.50 and 329.45, respectively.

Against UAE Dirham, the PKR lost 5 paise for buying and 1 paisa for selling, closing at 77.33 and 78.03, respectively.

Against Saudi Riyal, the PKR lost 10 paise for buying and 5 paise for selling, closing at 75.65 and 76.30, respectively.

Open-market rates for dollar on Friday

BID Rs 284.23

OFFER Rs 285.74