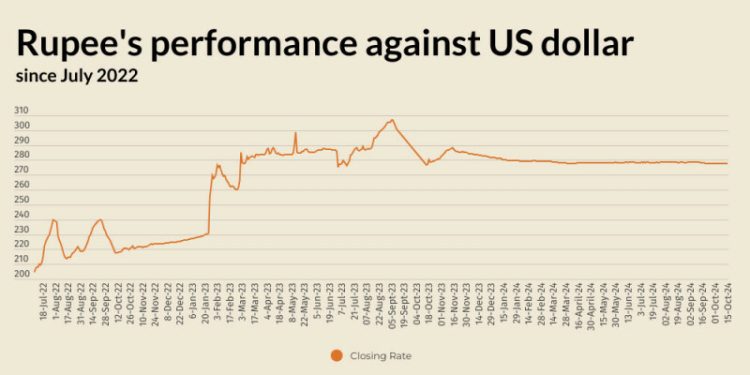

The Pakistani rupee recorded a marginal decline against the US dollar, depreciating 0.03% in the inter-bank market on Tuesday.

At close, the currency settled at 277.74, a loss of Re0.08 against the greenback.

On Monday, the rupee had settled at 277.66, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar was perched at an over two-month high against major currencies on Tuesday, spurred by wagers the Federal Reserve will proceed with modest rate cuts in the near term.

A string of US data has shown the economy to be resilient and slowing only modestly, while inflation in September rose slightly more than expected, leading traders to trim bets on large rate cuts from the Fed.

The US central bank kicked off its easing cycle with an aggressive 50 basis points at its last policy meeting in September but market expectations have shifted to a slower pace of cuts, boosting the dollar.

Traders are now ascribing 89% chance of a 25 bps cut in November, with 45 bps of easing overall priced in for the year.

The dollar index, which measures the US currency against six rivals, was at 103.27, just shy of 103.36, the highest level since Aug. 8 it touched on Monday. The index is up 2.5% and on course to snap its three-month losing streak.

Oil prices, a key indicator of currency parity, tumbled more than 4% to a near two-week low on Tuesday due to a weaker demand outlook and after a media report said Israel is willing to not strike Iranian oil targets, easing fears of a supply disruption.

Brent crude futures fell $3.51, or 4.5%, to $73.95 a barrel at 0911 GMT, their lowest since Oct. 2.

West Texas Intermediate futures lost $3.48, or 4.7%, hitting $70.35 a barrel. Both benchmarks had settled about 2% lower on Monday.

Inter-bank market rates for dollar on Tuesday

BID Rs 277.74

OFFER Rs 277.94

Open-market movement

In the open market, the PKR gained 1 paisa for buying and 10 paise for selling against USD, closing at 277.85 and 279.25, respectively.

Against Euro, the PKR gained 72 paise for buying and 73 paise for selling, closing at 300.73 and 303.57, respectively.

Against UAE Dirham, the PKR lost 2 paise for buying and remained unchanged for selling, closing at 75.27 and 75.97, respectively.

Against Saudi Riyal, the PKR lost 2 paise for buying and gained 1 paisa

for selling, closing at 73.47 and 74.10, respectively.

Open-market rates for dollar on Tuesday

BID Rs 277.85

OFFER Rs 279.25