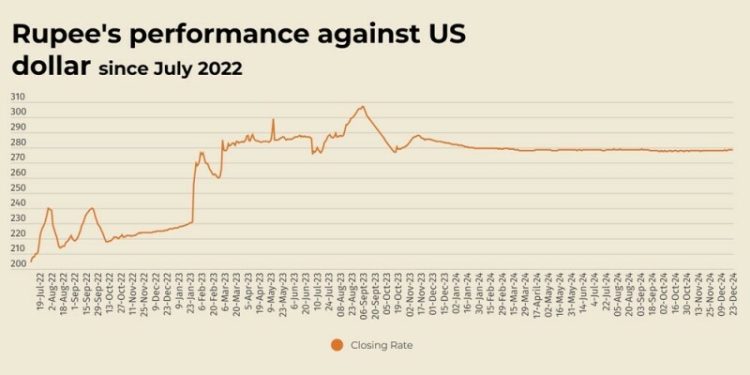

The Pakistani rupee registered a marginal decline against the US dollar, depreciating 0.05% in the inter-bank market on Monday.

At close, the currency settled at 278.57 for a loss of Re0.15 against the greenback.

During the previous week, the rupee decreased marginally against the US dollar as it lost Re0.30 or 0.11% in the inter-bank market.

The local unit closed at 278.42, against 278.12 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar was steady on Monday after US inflation data showed only a modest rise last month, easing some concerns about the pace of US rate cuts next year, while the yen loitered near 156 per dollar, raising the possibility of intervention.

Investor sentiment was also lifted when a US government shutdown was averted by Congress’ passage of spending legislation early on Saturday.

In a holiday-curtailed week, trading volumes are likely to thin out as the year-end approaches.

The Federal Reserve last week shocked the markets by projecting a measured pace of rate cuts ahead, sending Treasury yields and the dollar surging while casting a shadow on other economies, especially in emerging markets.

Friday’s data on the Fed’s preferred gauge of inflation showed moderate monthly rises in prices, with a measure of underlying inflation posting its smallest gain in six months.

The dollar index, which measures the US currency against six of its largest peers, remained steady at 107.78 on Monday, near a two-year high of 108.54 touched on Friday.

Oil prices, a key indicator of currency parity, rose on Monday as lower-than-expected US inflation data revived hopes for further policy easing, although the outlook for a supply surplus next year weighed on the market.

Brent crude futures rose 37 cents, or 0.5%, to $73.31 a barrel by 0729 GMT.

US West Texas Intermediate crude futures climbed 40 cents, or 0.6%, to $69.86 per barrel.

Inter-bank market rates for dollar on Monday

BID Rs 278.57

OFFER Rs 278.77

Open-market movement

In the open market, the PKR lost 29 paise for buying and 21 paise for

selling against USD, closing at 277.79 and 279.59, respectively.

Against Euro, the PKR lost 1.39 rupee for buying and 1.75 rupee for selling, closing at 288.74 and 291.05, respectively.

Against UAE Dirham, the PKR lost 4 paise for buying and 5 paise for selling, closing at 75.57 and 76.10, respectively.

Against Saudi Riyal, the PKR lost 5 paise for both buying and selling, closing at 73.85 and 74.35, respectively.

Open-market rates for dollar on Monday

BID Rs 277.79

OFFER Rs 279.59

The Pakistani rupee registered a marginal decline against the US dollar, depreciating 0.05% in the inter-bank market on Monday.

At close, the currency settled at 278.57 for a loss of Re0.15 against the greenback.

During the previous week, the rupee decreased marginally against the US dollar as it lost Re0.30 or 0.11% in the inter-bank market.

The local unit closed at 278.42, against 278.12 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar was steady on Monday after US inflation data showed only a modest rise last month, easing some concerns about the pace of US rate cuts next year, while the yen loitered near 156 per dollar, raising the possibility of intervention.

Investor sentiment was also lifted when a US government shutdown was averted by Congress’ passage of spending legislation early on Saturday.

In a holiday-curtailed week, trading volumes are likely to thin out as the year-end approaches.

The Federal Reserve last week shocked the markets by projecting a measured pace of rate cuts ahead, sending Treasury yields and the dollar surging while casting a shadow on other economies, especially in emerging markets.

Friday’s data on the Fed’s preferred gauge of inflation showed moderate monthly rises in prices, with a measure of underlying inflation posting its smallest gain in six months.

The dollar index, which measures the US currency against six of its largest peers, remained steady at 107.78 on Monday, near a two-year high of 108.54 touched on Friday.

Oil prices, a key indicator of currency parity, rose on Monday as lower-than-expected US inflation data revived hopes for further policy easing, although the outlook for a supply surplus next year weighed on the market.

Brent crude futures rose 37 cents, or 0.5%, to $73.31 a barrel by 0729 GMT.

US West Texas Intermediate crude futures climbed 40 cents, or 0.6%, to $69.86 per barrel.

Inter-bank market rates for dollar on Monday

BID Rs 278.57

OFFER Rs 278.77

Open-market movement

In the open market, the PKR lost 29 paise for buying and 21 paise for

selling against USD, closing at 277.79 and 279.59, respectively.

Against Euro, the PKR lost 1.39 rupee for buying and 1.75 rupee for selling, closing at 288.74 and 291.05, respectively.

Against UAE Dirham, the PKR lost 4 paise for buying and 5 paise for selling, closing at 75.57 and 76.10, respectively.

Against Saudi Riyal, the PKR lost 5 paise for both buying and selling, closing at 73.85 and 74.35, respectively.

Open-market rates for dollar on Monday

BID Rs 277.79

OFFER Rs 279.59